Payments' Fourth Turning

Freeing the Internet of Value

“Who Controls Money Controls the World”

Danksharding. Data-Availability. Data-Sampling. Modular. Monolithic. Fractal. FireDancer. TinyDancer. Merkle trees. Verkle trees. Staking. Liquid Staking. Restaking. FHE. AVS. ZK-Snark. Zk-Stark. Zk-sync. Zk-coprocessors…

Sometimes it feels like the crypto community loves geeking out over new infra so much that it misses the forrest for the trees: the actual point of all of the new infrastructure...

To build new applications FOR USERS.

Looking at the onboarding funnel today, it’s almost like crypto doesn’t want users:

KYC'd exchange account (send in all docs, wait ~1 week)

Fund from a COBOL ridden tradfi account

Buy a hardware wallet and "secure" 24 word seed phrase (oh ya, if done improperly…)

Download extension for web-native wallet (get another 24 word seed phrase prompt)

Connect hardware wallet to web native wallet

Send money from exchange to web native wallet (don't forget about all the taxes and reg filings!)

Link wallet with protocol (but make sure its legit so your funds don't get drained!)

Pay $150 for a Uniswap transaction because of scaling limitations on Ethereum...

This is odd because crypto aims to be a new network of value. Per Metcalf, the financial value of a network is proportional to the square of the number of connected users of said network. In many ways, the utility of parallel crypto networks can only become apparent once the network has reached a certain density - a tipping point in the flywheel between users, merchants, and developers.

To put it simply, the success or failure of the crypto experiment will depend on its most simple use case: payments. Bootstrapping a multi-sided network which provides the frictionless value exchange between participants at global scale on which other financial services depend.

This is contingent on a world of sovereign wallets as ubiquitous globally as WeChat and AliPay are in China. Which is contingent on solving two of crypto’s three largest bottlenecks1:

The horrific onboarding experience / UX

The paradox of mobile distribution

A few years back, I co-authored a post alongside Byrne Hobart from the diff - The Road Not Taken - outlining the evolutionary pathways payments have taken in major corners of the globe. The vision for a new financial system will depend on building a superior offering to prior generations of financial networks attracting enough users and payment flows into a parallel system - to reach an inflection where the utility can truly shine.

Fortunately, we are seeing greenshoots emerge in our coveted infrastructure overhaul: a trojan horse to bootstrap an open financial system from within the walled gardens of the mobile leviathans. The natural successor to the prior three generations of exchange.

The Fourth Turning.

Geography 101: Speed-Running Payments

1.0: U.S. - ducktaping the pipes

The primary reason the western internet remains so broken is payment networks matured in an analog world: the internet's "original sin". Birthed in the 1960s, the payments value-chain is anathoma to seamless online transactions: cardholders, merchants, issuing banks, merchant acquirers, card networks, payment processors, payment gateways... Simply mapping the legacy financial plumbing onto the digital world requires a stable of multi-decacorns like Stripe and Adyen to relay information across the spider-web of ancient counter-parties. Friction-filled checkout pages and a 3% tax on transactions are clearly not the future of france nor the end game for "growing the gdp of the internet".

2.0: China - the aggregators that ate the system

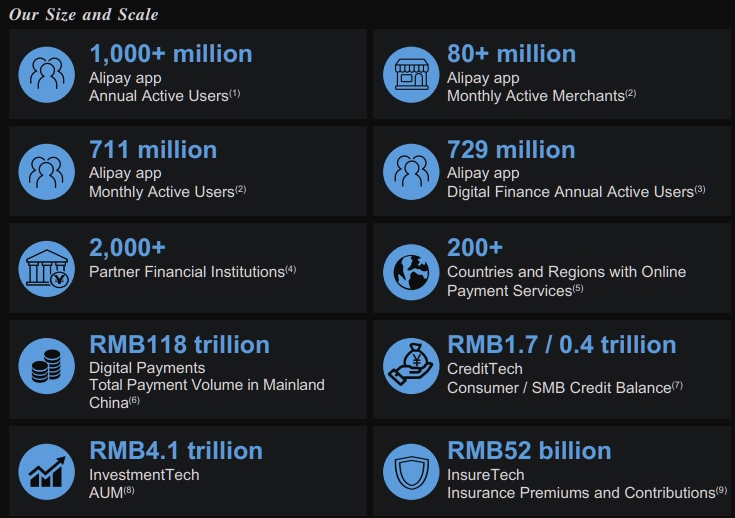

Chinese internet giants learned from the shortcomings of their US predecessors. Riding the mobile revolution, early leaders in payment-adjacent use cases like eCommerce (Ant) and Social (WeChat) realized how critical "owning the wallet network" would be towards horizontal expansion into the unending whitespace that was the Chinese mobile internet of the early 2010s. The blitzscaling went omni-channel, with both giants burning billions in offline merchant acquisition to create frictionless, closed loop payment networks. As opposed to working through the stagnant banking system, WeChat and Ant simply cut it out entirely, swallowing the value chain in its network of ubiquitous QR codes and mobile wallets. (Later reigned in by the PBOC)2. The reduced friction led to an explosion in activity…

Source: Ant Financial S-1 in 2020, the last public info available prior to the famed Jack Ma speech and subsequent pull of the Ant IPO. RMB 118trillion = ~US$17T in 2020 (!!!)

… as the SuperApps effectively became the internet. Tightly integrated monopolies with both user and data network effects led to unprecedented advantages in underwriting other financial products and affiliate services: the openness of the web, sacrificed for the seamless convenience of a walled garden.

3.0: The India Stack - the technocrats strike back

With a ~US$550m injection for 25% of PayTM, Ant must have been salivating over a second coup across the Himalays: another 1.4 billion consumers, with limited financial access, and rocketing digital penetration. Run it back, turbo.

Learning from China's effective financial privitization, Indian regulators preemptively pried open the payment rails - building a suite of open APIs and digital public goods: the "India Stack" - the current gold standard for national payments infrastructure.

Leveraging earlier investments in Aadhar, India's ubiquitous 12 digit identification number based on biometric and demographic data, NPCI rolled out the Unified Payments Interface (UPI) suite - a real-time mobile payments network open to third party integrations and capping flows at 30% share. The results have been… impressive.

Source: NPCI.org official stats (converting to USD as of Feb 18, 2024, current RR trxn values are ~US$1.8 trillion)

In many ways, the unlock provided by UPI in India - credibly neutral rails allowing for open integrations and frictionless mobile payments - is a miniaturized, less dynamic vision for a world of ubiquitious crypto wallets.

If only the cypher punks can solve distribution...

The Mobile Leviathans

As readers know, I believe the mobile duopoly is one of the larger barriers to crypto adoption.

the internet is increasingly accessed on mobile (~92% of users,~62% of traffic3)

The mobile internet is intermediated by apps

App stores and their mobile operating systems are a duopoly

Mobile Operating System Market Share

You see the problem. To reach global adoption, crypto will need a seamless mobile offering. Unfortunately, distribution is dependent on the very gatekeepers crypto aims to disrupt. Unsurprisingly, duopoly incumbents clipping 30% on all walled-garden transactions are not super accomodating to catalyzing the open networks who aim to undercut this rake.

Fortunately, the latches of the trojan horse are already loosening within Tim Apple's high walls.

Turning... 3.5?

Telegram has >800m MAUs. Based on reliable sources4, growth is actually accelerating, making it possible Telegram could top ~1.5b users in 2024. >52% of these users are between 18 - 34, primarily hailing from the global south (downloads by geo: >104m in India, 34m in Russia, 27m in Indonesia, 27m USA, 22m Brazil, 15m Egypt, 12m Vietnam, 12m Mexico, 11m Ukraine, 10m Turkey, 10m Philippines, 9m Nigeria)

Problem: fiscal mismanagement and friction-filled payments in many of these jurisdictions

Product: integrated, easy-to-use third-party crypto wallets

Market: 800m MAUs, growing ~60%? YoY... (yes, bananas...)

Fit:

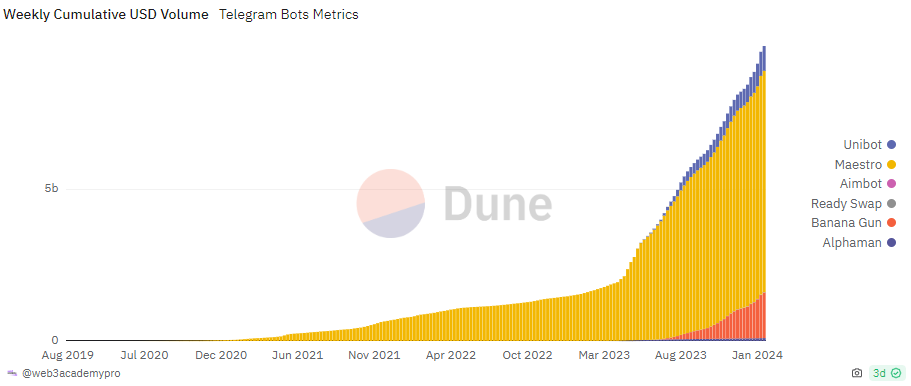

First off, the bots. In many jurisdictions, bots are deemed seperate persons - almost like talking with a friend - making interactions protected under "free speech" statutes. Who are you to say who I can and cannot chat with in my encrypted chat? And so what if that agent happens to interact with an adjacent wallet...

Mechanically, when engaged, the bot fires up an external web app - auto-loading login creditials into a new screen with a UX so smooth the transition barely registers.

This playbook is now attracting third party developers. Telegram is one of few applications at internet scale, promising distribution of the same magnitude as the leviathans themselves. While early, TG is leaning hard into mini-apps - bots or imbedded buttons which open to web-apps - providing developers access to users on a viral network with noticeably lower CACs, while conveniently avoiding the extractive tax rates and arbitrary dictates of the incumbents.

Like WeChat's position as the gateway to an integrated Chinese internet, Telegram aims to leverage crypto rails to provide a similar experience to hundreds of millions across the global south.

@Wallet is a good example. The bot - developed by TON - offers both self-custody and third-party custody solutions (the default) with the encrypted private key managed by the bot itself, tied to a user’s Telegram ID. The onboarding experience is frictionless - enabling fiat or P2P funding of 1) Bitcoin purchases, 2) USDT on Tron, and 3) the TON token currently, with rumours of a sizable asset pipeline.

Networks built ontop of networks can reach adoption much faster than the initial infra build out.

Telegram may just pull off the coup of the century, bootstrapping a global mobile wallet network on the back of the incumbents themselves.

But even if the empire strikes back on TG, the floodgates are beginning to open. Like AliPay and WeChat Pay, native payments will soon be integral to all consumer applications, but independent of a biased rival. And similar to how an ERP is only ripped out when the legacy system is simply intolerable, perhaps the west will bring "leapfrogging" full circle - being the first to undergo a complete infrastructure overhaul.

Cracks in the Levy

Farcaster is a "sufficiently decentralized social network protocol" (similar raison d'être to DeSo), now undergoing an early inflection. Much of its recent success is driven by streamlining the traditionally friction-filled onboarding experience of on-chain social through tactical private key management and on-chain, off-chain triaging.

Farcaster is most easily accessed through the Warpcast mobile app. For normies, the experience is fairly seamless - spinning up a "custodial key pair" on Optimism and storing the private key within Apple's keychain - cleverly outsourcing security to the leviathan it evades. Secondary "signing" key pairs are used to provide permissions to applications who sign messages on behalf of the users without exposing the primary "custodial" private key. The mechanism is ingenious in its simplicity.

The address is associated with a Farcaster ID: a unique identifier, governed by the private key which can double-hat as a sovereign wallet on crypto rails.

Developers are already taking advantage of these novel properties - imbedding "Frames" (mini-apps) directly into a users feed - allowing for one-click purchases or mints in the app itself.

While early, we are beginning to see what the future can look like with a network of native crypto wallets: the user experience of WeChat, with the open rails of UPI, combined with the permissionless creativity of opensource.

The Fourth Turning

Crypto skeptics do not understand the chicken and egg problem in a payments network. The value of the network expands exponentially with each new joiner. The use cases - for payments, lending, insurance, targeting and more - will depend on the number of users, merchants, and developers who enter the ecosystem.

To date, bootstrapping this network of independent wallets has depended on digital and regulatory infrastructure with incentives stubbornly against its proliferation.

In a funny way, because of this friction, crypto has limited users, limiting the utility of the network - meaning the space keeps running the front-end (speculative phase) of the Gartner hype cycle on repeat, laying more and more infrastructure without real traction.

This is changing.

The creative onboarding solutions used by messaging giants like Telegram or disrupters like Farcaster provide a blueprint to the next generation of consumer apps looking for distribution from within the walls of the extractive monopoly. A combination of social wallets, bot interfaces, and seamless web-apps mean the app-store's monopoly days are numbered.

At the exact moment market participants tire of another wave of crypto speculation without apparent utility, the wallet network will begin to reach a turning point...

The fourth turning.

Winners & Losers

The impacts of a world of ubiquitous mobile crypto wallets will not be evenly distributed. The below scratches the surface as to how the onslaught of the fourth turning is likely to slice and dice incumbents.

Winners

Telegram: first mover in the "global south" bridging folks to crypto with the potential to become a cross border “super app” (though reg / app store risks are real)

Social / Entertainment Giants: inserting payment flows seamlessly anywhere with eyeballs will be a big win for those with eyeballs

Headless Marketplaces: consumer startups and mom & pops looking for distribution outside of the rising CAC on tech aggregators

Saga Mobile: it will become abundently clear why this is a good idea

BTC/ETH/SOL: assuming we actually start to build applications, the incubment "operating systems" will likely start to pull away from the pack with user and developer mind share

Real DeFi Use Cases: all the products downstream of payments

Liberalism: freedom of exchange, protected property rights, censorship resistance baked into the fabric of the internet itself...

Gambling / Memes / Leverage: people don't always use freedom in the most responsible manner... dogwifhat 10x, comes with the territory

AI agents

The GDP of the internet :)

Losers:

The Bankers: all things legacy finance

The Mobile Leviathans: that 30% is looking real sus

Third World Monetary Sovereignty: what happens when anyone with a mobile internet connection can seamlessly hold USDC or BTC? (Capital controls exist for a reason...)

US and China (govt’s & citizens): the most powerful nation states have the most to lose from a neutral infrastructure overhaul (though for different reasons)

"Alt Layer 1s": consumers and dev's coalescing around chains with consumer and developer flywheels as infra gives way to consumer adoption

Boomers: if you want to bankrupt the system, fine. But don’t complain when we make a new one.

"He who controls the money supply of a nation controls the nation" - James A. Garfield

I think the same can be said for the rails on which that money resides.

Remember, chaos is a ladder ;)

The third is scaling, but innumerable volumes have been spilled on this already.

Beginning in 2017, the PBOC introduced regulations that wrestled Alipay and WeChatPay deposits bank into the traditional financial system. Link

“Internet Traffic from Mobile Devices (2022) by Josh Howarth

I have friends

![OC] Time it took to reach 100 million users worldwide : r/dataisbeautiful OC] Time it took to reach 100 million users worldwide : r/dataisbeautiful](https://substackcdn.com/image/fetch/$s_!ITYO!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F13e6d361-4289-4994-9dec-228395a3b3eb_3600x3600.png)