$DeSo: Jailbreaking Status-as-a-Service

Web3 Social and Next-Generation Status Games

This week, we explore the investment thesis for the $DeSo token - an early pioneer in web3 social media. As the post is on the longer side, I chose to test out uploading an audio version above for those who prefer an alternative medium. Feedback welcome!

This week, topics include:

Humans as status-seeking monkeys; social media has found massive product-market-fit by more efficiently distributing status

Today’s social media incumbents provide poor means of monetizing the status which is so arduously won by creators and users - extracting most financial benefits for themselves

$DeSo (short for Decentralized Social) hopes to build an open infrastructure layer to breakopen the data monopolies, enabling creator and developer autonomy and limiting user lock-in to engender more dynamic digital economies

Despite challenges in scaling, limited traction to date, and increasingly fierce competition, at a ~US$70m fully-diluted market value, $DeSo is starting to look more interesting from an investment perspective as part of a diversified, high-risk portfolio

***As always, this is not investment advice, crypto investing is risky, do you own research***.

Status-Seeking Monkeys

We are all status seeking monkeys1. The desire for recognition as alive and well now as in the time of Hegel. Today, we just have more efficient tools. From priest to aristocratic rank, to corporate title, we have now arrived at the hyper-efficient world of networks. Twitter for wits. Instagram for beauty. TikTok for creativity (& thirst traps). Substack for lowly aspiring scribes :). The hunt for status marches on.

The modern digital economy is built on attention. In a world of infinite online distribution, the ability to captivate a few of the 15.6 billion eyeballs on the planet is valuable. Many of the corporate behemoths: Facebook, YouTube, TikTok, Douyin, Snap, Instagram, Kuaishou and more are carefully crafted to foster engagement… upstream of monetization.

Clearly, they have tapped into something. Status games are at the core of human nature and have thus exhibited unparalleled product-market-fit.

Source: Wikipedia, reflectiondigital.io

By preying on the human desire for status, these social media networks have garnered large user bases. More and more monkeys playing status games in attention-seeking tournaments. The more work the monkeys do, the more spectators come, and the higher ticket prices charged by the gatekeeper.

These networks are “closed”. Instagram’s social graph is the sole property of Meta. TikTok’s algorithm is a closely guarded secret. All of the user-generated-content within each of these platforms is the property of… the platform itself.

In this way, the platforms are able to exploit status-seekers’ desire for recognition by getting them to perform work whose monetary value accrues largely to a third-party.

Decentralized social (i.e. web3 social) hopes to break these chains.

Web3 Social - Opening Up the Infrastructure

The web3 social movement is predicated on breaking open these data monopolies. If the status-games were played atop open, neutral architecture, the creators and users would not be subject to the whims of the platform. In my view, its less about “censorship-resistance” or purifying the “ad-driven outrage economy” which is “destroying our democracy” (enough already), but simply around consumer choice, better creator economics, greater dynamism, and the always important “ability to exit”.

In many ways, web3 social is a bet that open ecosystems (like the internet) will eventually win out over closed ecosystems. The internet vs. the intranet. Linux vs. Windows. New York City vs. Facebook’s Menlo Park campus. There is simply more intellectual horse-power and creativity outside any organization than within.

Web3 social is a bet that the next-generation of status games built on open networks will have more dynamic economies. Creator tokens, direct tipping, NFTs, streamed subscriptions, gated access, influencer stock markets and a host of other wild experiments; a minority of which will likely usurp advertising as today’s sole monetization framework with its negative externalities, click-bait content, and limited payouts to creators themselves. It’s very early, but in my view, adoption feels inevitable; a simple thesis that open networks will generally win out in the end.

One of the few “listed” pioneers in the space is a foundation called “DeSo”, short for “Decentralized Social”.

The Rise and… Stagnation of $DeSo

DeSo’s vision is to build a new blockchain: one purpose-built for social use-cases. General-purpose-chains like Ethereum are not streamlined for social media applications. The underlying architecture for twitter is quite different from that of the NASDAQ, for instance. The scale of transactions needed to host social applications - with millions of posts, likes, comments, profiles, and social graphs - is different from financial transactions or data storage or telecom-networking.

DeSo aims to build the infrastructure on which the next-generation of Mark Zuckerbergs, Jack Dorseys and Zhang Yimings will build more open social applications to challenge the web2 incumbents. Every profile, every comment, every follow is built on an open code base. No data monopolies. No user lock-in. No developer rugs. Anyone can build applications atop this data set.

Source: Deso.org.

DeSo rocketed into the mainstream in 2021 with the launch of its proto-type application: BitClout. BitClout was essentially a decentralized twitter clone which bootstrapped initial interest through “reserving profiles” for tech twitter royalty like Naval, Chamath, and Balaji in hopes of igniting escape velocity from the gravity which is any social networks’ “cold start” problem. After some initial traction, BitClout has largely flamed out. Short-comings in infrastructure, onboarding friction, and controversy with “impersonating” mainstream actors were enough to send BitClout into the footnotes of social media lore.

However, the rise to stardom was enough to raise US$200m with participation from crypto titans a16z, Coinbase Ventures, Social Capital, Polychain, Pantera, Winklevoss Capital Management, and DCG among others.

Armed with a sizable war chest, DeSo is now focused on scaling out a specialized Layer-1 infrastructure solution on which the future of social can be built.

The Bull Case

The bull case for DeSo is pretty simple: a quick scan at the market cap of leading social networks today2…

Meta at ~US$450b

Bytedance at ~US$300b

Kuaishou at ~US$40b

Twitter at ~US$34b

Snap at ~US$19b

In stark contrast, the price of DeSo has cratered as speculation has evaporated amidst the Fed tightening cycle. After peaking in October at a US$1.6b market cap, DeSo now languishes at a mere ~US$70m3 - a 95%+ decline.

In many ways, the decline is merited given the dampening of 2021 market euphoria and the lack of traction / developer activity on the protocol. However, other data points are starting to make this more interesting. The market capitalization is at a steep discount to the ~US$200m raised in 2021. Depending on the burn-rate and fluctuations in the treasury value (i.e. the funds were raised in BTC; depending on how much was diversified into fiat, the 5000 BTC raised would still be worth a minimum of US$105m at today’s depressed prices assuming none were sold), there is a substantial likelihood that $DeSo today may be trading at a discount to treasury! (Please note: I have not been able to confirm this).

There are several Twitter clones being built atop DeSo as we speak (though notably with dismal usage). In the event a successful decentralized twitter clone emerges, even with only ~50% of the value capture of the fabled bird app (who itself is notoriously poor at monetization), investors would be staring at a ~200x+ gain from today’s prices. As a baseline infrastructure and not a builder of applications itself, DeSo may benefit from a range of experiments outside of just one app like Diamond. The chain hopes to play host to social DAOs, vibrant NFT markets, creator tokens, gated communities, encrypted messaging services and other novel applications yet to be invented. It has announced a US$50m fund to support the ecosystem and has invested US$11m in the first “cohort” of aspiring applications. Instead of relying on the odds of one startup, DeSo may prove to be a diversified bet on the early, yet exciting category as a whole.

From a tokenomics perspective, $DeSo does not suffer from any token overhang. Only 300k of the 10.8m total tokens outstanding remain for incentives. While the project risks not having enough firepower to incentive onboarding new nodes, the familiar sell pressure from extended token release schedules will not be a factor here.

This is essentially a high-risk venture bet on an unproven, but well-funded project in a compelling category.

The Bear Case

In my opinion, the bear case is three-fold:

Technical Risks

Limited Traction Exhibited

Increasing Competition

I’m not worried about product-market-fit. Humans love status games and status games on superior infrastructure (if technically feasible) will be big business. I’m also not too worried about technical feasibility - its more of a question of time. Thus, the list above morphs into the three fundamental questions:

How long until the tech is available at scale?

Who is the right horse to bet on?

How much am I willing to pay today in light of the two answers above?

Scalability - the path to 1 billion users

DeSo’s scaling roadmap involves a four-step plan to increase the number of transactions (posts) per second to “twitter-esk” throughput levels:

Proof-of-Stake:

Similar to Ethereum, DeSo is undergoing a shift from a hybrid proof-of-work (Bitcoin consensus mechanism based on computers solving math problems) to a proof-of-stake mechanism (based on financial incentives).

This helps decrease energy needs and pave the way for other parts of the scaling roadmap below.

Bigger Blocks

Average DeSo post size is 218 bytes = ~ 10 posts per second4

An increase in the block size will get to ~ 80 posts per second

Twitter currently has ~6000 posts per second with 300m users

80 / 6000 means DeSo should be able to support a twitter application for ~4m users with larger blocks

Warp Sync

Long-story short: warp sync = even larger blocks and limited need for every node to download the full history of the blockchain. This can allow ~1800 posts per second or ~30m active users (in twitter-equivalent metrics)

For crypto nerds only: The scaling description feels similar to Ethereum’s roadmap of data-availability-sampling to help scale throughput and limit requirements on each node while still insuring all data was made available for anyone to check (then history can be backed up by “archive” nodes)

Sharding

Basically, splitting the blockchain into sub-shards to increase throughput

30x shards = ~10x multiplier on TPS providing the roadmap to ~1 billion users over time

The gist: DeSo believes social applications require less decentralization than financial chains like Bitcoin or Ethereum striving to be immutable even in the event of state-sponsored attacks. DeSo does not feel as constrained by decentralization requirements and is willing to make trade-offs on block size and specialized hardware to validate the chain. Decentralization is a spectrum, and for social applications, scale and speed matter most - you just have to be decentralized… enough.

Traction

Despite the compelling vision, a stroll on over to open prosper analytics brings us back down to earth from the lofty vision.

Wallet (green) and Creator (blue) growth have clearly stagnated over the last year…

Transactions are far from exhibiting exponential growth…

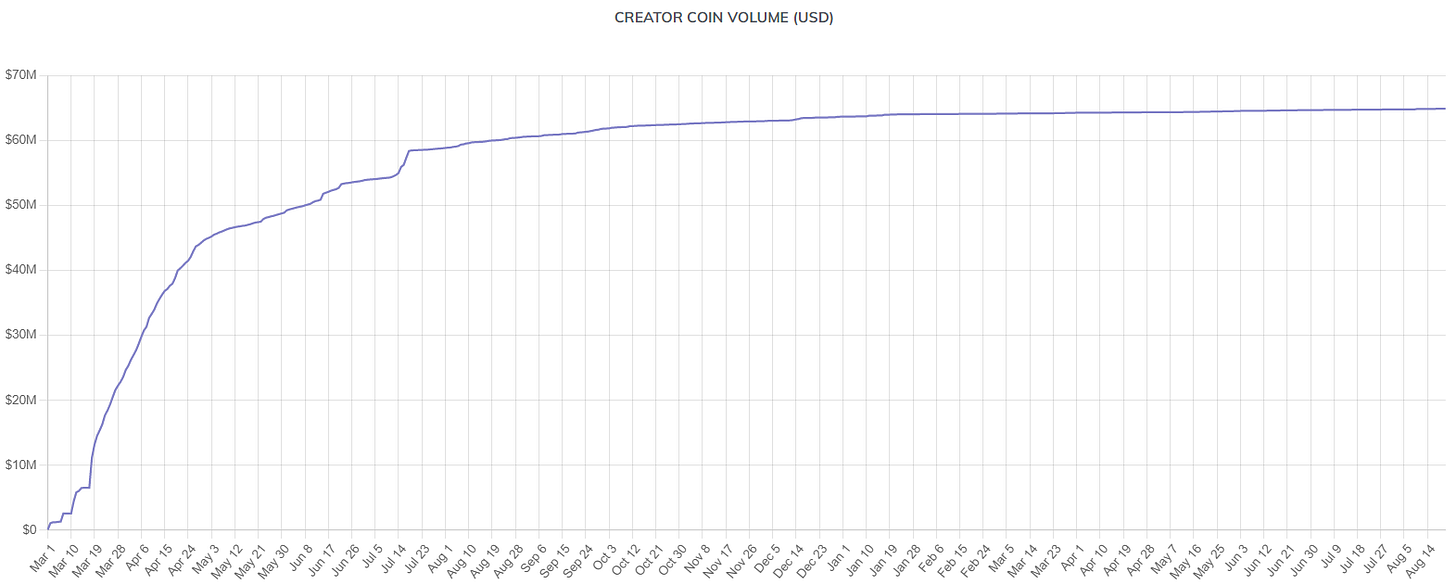

Creator coin volume (think speculation on value of ecosystem creators) is basically dead…

Initial star power has faded… most celeb’s like Chamath have not posted in over a year.

If anything, these dismal data points likely over-state current adoption as churn appears absent from the above statistics. Monthly active and daily active users are likely a fraction of the total above.

That being said, we are still in the infrastructure phase of DeSo’s journey and said infrastructure is still a work in progress. That the application layer is not thriving and and usurping the web2 incumbents at this stage is not surprising.

However, the underlying fundamentals arguably merit the 95%+ decline we have witnessed.

Competition

The competitive landscape is where things are heating up.

With >50% of the world’s population and ~1 trillion in market capitalization for the web2 incumbents, it’s no surprise decentralized social is beginning to attract large investment rounds and quality talent. The below represent a few of the most highly anticipated projects set to compete directly with DeSo for developer talent in the year ahead:

Lens is built by crypto veteran Stani Kulechov of Aave5 fame

The protocol is built on Layer-2 scaling solution Polygon and provides developers with a modular set of social primitives - largely a suite of NFTs which can be used by app devs to map underlying social interactions

The project has yet to launch but will benefit from Ethereum’s security, a proven team, and a strong initial community

Aptos, alongside Mysten Labs (see below), are the new hot Layer-1s targeting social and gaming use cases; the Solana’s of the coming cycle.

The Aptos team spun out of Diem - Meta’s previous crypto development team - boasting A-listers in distributed systems research, engineering, and design

The team claims to have a more scalable blockchain with up to ~160,000 transactions per second and is based on the “Move” developer language: a more flexible, secure programming language for open-source development which it claims is superior to Ethereum’s solidity

Mysten Labs is similarly founded by former Meta employees and also utilizes the Move language

Formed by the former “Novi” research team focused on crypto wallets and payments at Facebook, the team has their own high-performance proof-of-stake blockchain “Sui” also targeting social, gaming, and commerce use cases

Sui appears similar to Aptos in terms of proposed scalability and node requirements. Both aim to launch on mainnet later this year.

Lens is backed by DeFi unicorn Aave (1.4b FDV) while Aptos and Mysten have both raised large rounds at generous valuations. Aptos recently bagged another US$150m (bringing this year’s funding to US$350m) at a reported valuation of US$2b led by Jump and FTX Ventures. Mysten Labs is in talks to raise ~US$200m at a US$2b valuation also led by FTX Ventures. This is serious ammo both in terms of funding and talent.

Are these projects more likely to succeed than $DeSo? Yes.

Are they ~28x more likely to succeed than $DeSo? Far less certain…

The Incumbents

The other elephant in the room is the incumbents themselves. Meta with ~3b users, a telling name change, and investments totaling US$10b last year in its metaverse division - Facebook Reality Labs - is not to be dismissed. Tencent and Bytedance will fight in China and abroad. Twitter has been integrating more monetization features like “tipping” and working on it’s own decentralization initiatives at Bluesky.

As with any disruptive trend, the classic “innovators dilemma” makes it exceedingly painful for incumbents to self-disrupt given how much they benefit from the status quo. However, Zuckerberg already reinvented Facebook multiple times before: from web → mobile and from Facebook → Instagram, cloning features from Snap and TikTok along the way, and now partnering up with the NFT-veterans at Flow. Dorsey is a serial-founder with a demonstrated love for the Orange Coin.

Network effects are powerful for a reason and the incumbents hold many cards - distribution, talent, data sets, and social graphs. Breaking free of the old paradigm will not be a walk in the park. It’s especially difficult to count out those networks which are still founder-led.

In Conclusion…

We are status seeking monkeys. This will not change. However, the current arenas in which we play our status games provide a suboptimal experience in monetizing the newly-found status for which we work so hard. By opening up the data-silos of the incumbents, web3 challengers hope to provide more vibrant virtual economies with more broadly distributed gains.

DeSo is one of few publicly available “pure play” tokens attacking this large market opportunity. Because of the evaporation in speculation and the limited traction demonstrated, the fully diluted market cap has dropped ~95%+ to just US$70m. At a ~US$70m fully-diluted valuation, the token may be trading at a discount to treasury (having raised US$200m in 2021)6.

Let me be clear: I think DeSo is likely to fail. The odds are stacked against it and traction is wanting.

However, as a small portion of a high-risk, diversified web3 social basket for those (like me) excited about the theme, I think the expected value is fairly attractive.

I anticipate web3 social being a material emerging “narrative” during the next crypto upcycle with many market participants keen for thematic exposure and developers attracted back into the ecosystem by reinvigorated enthusiasm.

DeSo is one of few retail tokens available to play this theme directly. In an upcycle, I would not be surprised to see DeSo reach ~US$700m+ on speculative fervor; (and potentially higher long-term if real development activity returns to the protocol). The odds are low, but with the current 95% decline, now trading at a potential discount to treasury, and a 10x+ upside, the bet is beginning to look more asymmetric by the day.

From the now enshrined silicon valley canon: Status as a Service (StaaS) by Eugene Wei

August 22, 2022

August 22, 2022

DeSo Documentation: https://docs.deso.org/about-deso-chain/readme

Aave, formerly Eth-Lend is one of the largest on-chain money markets in DeFi

Difficult time verifying treasury assets which is a frustrating lack of transparency by the foundation