TreasureDAO ($MAGIC)

Confessions of a non-gamer

Shorter note this week given all of the Token2049 and F1 Festivities here in Singapore (yes - I’m back in town :) ) . If you are keen for something more meaty to chew on, I would recommend last week’s report on the convergence of AI and Crypto.

This week we cover decentralized gaming studio TreasureDAO.

Disclaimer: this is not investment advice, please do your own research, crypto is risky.

- PD

The Nerds Have Won

In crypto circles, I always feel a bit sheepish when the topic of “gaming” comes up. Each guy1 warmly recalling his go-to titles of yesteryear; 40 hours+ per week honing the craft. Quake. Legends. StarCraft. WoW. DOTA. I awkwardly stare down at my no-longer-icy-white tiger onitsuka’s as the others flash their O.G. bona fides. My virtual childhood a barren desert, bereft of “screen-time” to a point where my older brother asked my mom if we were Amish.2

“Learn to play golf” they said. “That’s how you make connections in the business world.”

Alas, no. MANGA comics? Week-long WoW questing escapades? Representing Oceania in League of Legend tourneys?

Check. Check. Check.

Golf? Absolutely not. Not once.

The nerds have won. Dismiss it at your peril.

“We Are All Gamers Now”

My parents were right about many things, but putting down the controller for the clubs was not one. Today, 67 million people hit the lynx vs. the 3 billion who play video games. If you are speaking to someone under the age of 35, odds are they spent many of their formative years in front of a PC, Console, or smart phone playing games. On my arrival in Singapore, I quickly learned business dinners regularly devolved into gaming credentials.

The post-iphone mobile boom has brought the world’s new favorite past-time from the favelas of Rio to the rice paddies of East Java. Mobile-first games like PUBG and Free Fire have stepped into the void left by AAA studios catering to an emerging cadre of mobile-first gamers across South & Southeast Asia, Eastern Europe, LATAM and beyond.

Gaming is global.

Not only is the breadth staggering, but the industry has been on the cutting edge in terms of business model innovation: from Arcades → PCs → Consoles → Free-to-Play (+) on mobile → “Play-to-Earn”, the gaming industry continues to pioneer new, almost counter-intuitive paths to monetization.

Clearly, it’s working.

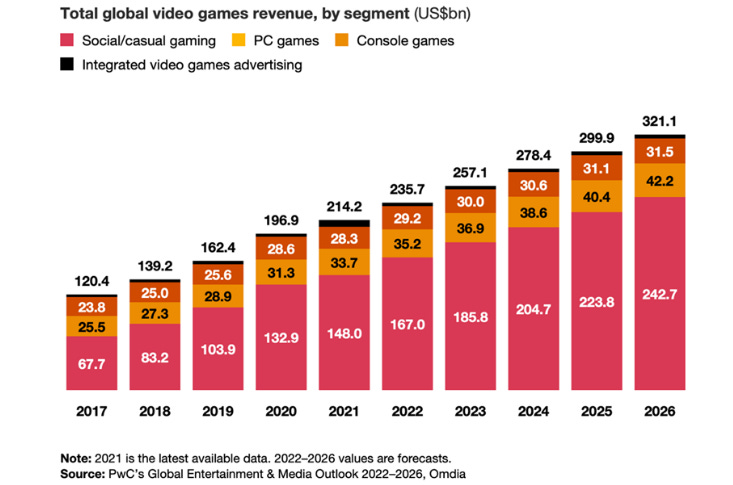

At ~US$250b, the video game industry is ~5x the music industry and ~2x+ the film industry. With an expected CAGR of ~10%+ on the back of emerging world expansion, the yawn will continue to widen.

Other entertainment mediums have languished in comparison.

Source: Matthewball.vc (figures slightly stale / understated but you get the point…)

My gaming “enlightenment” arrived when I first moved to Southeast Asia, a gaming hotbed, and I attempted to value internet conglomerate Sea Group. The numbers were staggering. At the time, 700m people (yes, 1 in 10 people on earth) were active users of Garena games, with a heavy concentration in just ONE title: Free Fire.

Long-story short: given its size and history of innovation, the gaming industry often provides early signals to the future of entertainment. As we shift to a world of digital property rights, new models are bound to transform the landscape once again.

This is why TreasureDAO deserves a closer look.

TREASURE DAO

For the unaware, Treasure is essentially a community-led gaming studio for web3 games. It’s DAO is governed by $MAGIC token-holders who make key decisions on behalf of the community. After launching a few internal titles, like BridgeWorld and Smolverse, TreasureDAO now aims to leverage its existing infrastructure to help launch new games in the web3 space.

Source: Bridgeworld User Guide

Instead of bootstrapping their own liquidity, userbase, and marketplaces from scratch, new games can partner with the DAO. TreasureDAO provides initial liquidity ($MAGIC rewards), marketplace infrastructure for the exchange of virtual goods, and allows for increased distribution to the community. In exchange, TreasureDAO takes 50% of the fees generated through its NFT-marketplace (2.5% to the DAO, 2.5% to the creators).

The ultimate vision is a Cambrian explosion of different games or “metaverses” tied together by a common currency, marketplace, and set of financial primitives, monetized primarily via secondary NFT sales in the common marketplace. A sort of bottoms-up “meta”-metaverse bridging a slew of different worlds.

The vision is compelling, but largely depends on the DAO’s ability to attract high-quality projects to the ecosystem to achieve the following flywheel:

With the current crypto backdrop, the flywheel is in real need of some centripetal force…

Tokenomics & Traction

Today, Treasure’s token $MAGIC is worth US$75m3, down from its March high of US$200m. In FDV terms, the valuation is ~US$130m. From a tokenomics perspective, the project's fair launch and limited token overhang minimize the risk of crypto's seemingly favorite past-time: "dumping on retail". However, the limited remaining firepower will also minimize the DAOs ability to attract more high-quality games to the ecosystem.

Token Release Schedule

In terms of utilization, the figures are pathetic compared with web2 gameplay. However, a resilient set of “core gamers” sticking around in the bear market provides a silver lining relative to “GameFi’s” utter graveyard following the implosion of the 2021 hype-cycle.

Soure: Delphi Digital, Dune Analytics.

Despite the decline in users, the remaining “core” appear as active as ever, indicating healthy economic activity by remaining players - continuing to provide fees to the treasury.

While the “bubble” elements in Axie Infinity’s rise are hard to ignore, its also important to note the difference between web2 and web3 games. Given the ownable nature of in-game assets, web3 games appear to have much higher monetization potential per user compared with their web2 counterparts - achieving higher market capitalization on much lower usage. Axie Infinity had just ~3m users at its peak, but a corresponding market cap of US$10b. TreasureDAO is a long way from 3m users, but apples to apples comparisons with web2 in terms of the usage can be misleading.

Raining on the parade….

Personally, I’m not sure I see TreasureDAO’s “right to win”. Despite the initial hype around the community and its first mover advantage, the scale of operations to date do not provide much of a moat. The intersection of crypto and gaming is poised for large infusions of both capital and talent in the years ahead.

The terrain remains largely unsettled; a vast expanse of whitespace with salivating entrepreneurs, investors, and incumbents looking to stake their claim. TreasureDAO’s claim is contingent on attracting high-quality devs who can attract users who underpin its vision of interoperable “metaverses”. This ability remains largely unproven.

Treasure is built on Ethereum Layer 2 Arbitrum which in itself significantly inhibits the addressable market in this land grab. The friction of onboarding via an exchange → setting up a Metamask → funding the wallet → and bridging to the Layer2, all before playing the game strike me as insurmountable to all except the ultra-crypto natives in its current form. The universe of perspective players today is constricted to Arbitrum’s ~100k+ daily active users.

Additionally, the gameplay quality needs to improve significantly to crack mainstream usage. I will not dive into individual titles here, but most are niche strategy games fueled primarily by crypto natives excited about financial speculation. Few of the existing titles or pipeline seem likely to draw users away from Fortnite or others based on gameplay alone…

With just ~2000 daily active users, TreasureDAO has a long way to go to prove it can be an anchor piece of infrastructure in web3 gaming. The race for a bottoms up metaverse is wide open with a lot of missing pieces.

Why can’t the first truly breakout web3 game leverage their user base to replicate a TreasureDAOs playbook at scale?

Given their relationship with the users, killer apps themselves will begin to insource much of the infrastructure around marketplaces and wallets (see StepN) to better monetize users. While TreasureDAO offers the benefits of diversification across a stable of games, the current quality of gameplay leaves me skeptical it will be the community which onboards tens of millions into crypto.

TreasureDAO is an early pioneer showing us what the intersection of gaming and crypto may look like in the future. The colossal market should see meaningful transformation over the next decade. Unfortunately, in my view, TreasureDAO seems likely to be surpassed by next-gen competitors along the way.

Sorry, but yes, 95%+ guys in this circle….

This is, in fact, a true story

Coingecko Magic market capitalization (Sept 27, 2022)

Hey i am also at 2049. If you wanna chat let me know. My twitter handle is @saushank_