The Fourth Wave

Crypto & Front-Running "The Next Cycle"

NOT AGAIN…

Crypto’s sell-off has been vicious. A combination of tightening financial conditions, limited “fundamental value” in the traditional sense, irresponsible leverage and lending, on-chain liquidation visibility, and social media reflexivity have led to a rapid deflation of crypto market capitalization.

For crypto OG’s, this is nothing new. Every four years, there is a reflexive uptrend, following by a violent cascade downward, only to level off at a higher base than the previous cycle. We are now stuck in the bear, getting dumped on by the “I told you so” boomer twitterati, patiently awaiting new narratives to propel the next influx of capital, adoption, and … speculative fervor, laying the groundwork for the next crash.

Despite the bear sentiment, several items remain unchanged:

Central banks still have no way out of their current predicament without subjecting citizens and investors to massively negative real rates for decades

The vision of crypto as a medium for trustless, more efficient global coordination is alive and well (even if price got ahead of traction in 2021)

In time, once crypto applications provide greater economic value to more constituents, digital commodities with algorithmically guaranteed scarcity will be viewed as a safe-haven against devaluation by central banks (like real commodities are viewed today). This cycle has proved too early.

Based on the early stage of penetration, irresponsible behavior by many parties, and the proliferation of ponzinomics this cycle, we have earned this bear market, a wave of punitive regulation, and a material stall in near-term adoption curve.

However, there will be another upcycle. There always is.

Compounding, composable opensource software with in-built financial incentives is still just an infant. The pace of innovation will only accelerate as ever larger venture funds get deployed, talent gets sucked in, and the infrastructure scales and hardens. From the sobering vantage of 2022, the ~90% drawdowns in 2014 and 2018 do not appear so devastating as time marches on.

Another market exhale on the logarithmic adoption curve of the next generation of the internet.

Crypto Waves: Deep Inhales, Fast Exhales

Crypto has a history of waves. The waves tend to be in ~4 year cycles. The midpoint of the cycle is driven by the “divinely ordained” bitcoin “halving”. For non-zealots, this marks a ~50% drop in new supply issuance (which holding demand constant, should see an increase in price).

However, there is more. Now, everyone knows everyone else is watching the BTC halving as a price catalyst. Therefore, its natural to bid in anticipation of others bidding alongside a known catalyst. George Soros’ famous reflexivity in action.

Bitcoin tends to lead the charge out of the bear market, followed by other multi-cycle blue chips (like Ethereum), followed by less proven, more speculative narrative-based tokens which thrive in the initial phase of the Gartner hype cycle.

While the least risky, Bitcoin’s and Ethereum’s size subject it to the law of large numbers. Hundreds of billions in market cap can only appreciate so much. The real money is made by those who predict the new “narratives” set to gain traction in the public consciousness; those patiently placing bets further out the risk curve when crypto critics are dancing gleefully on the industry’s grave.

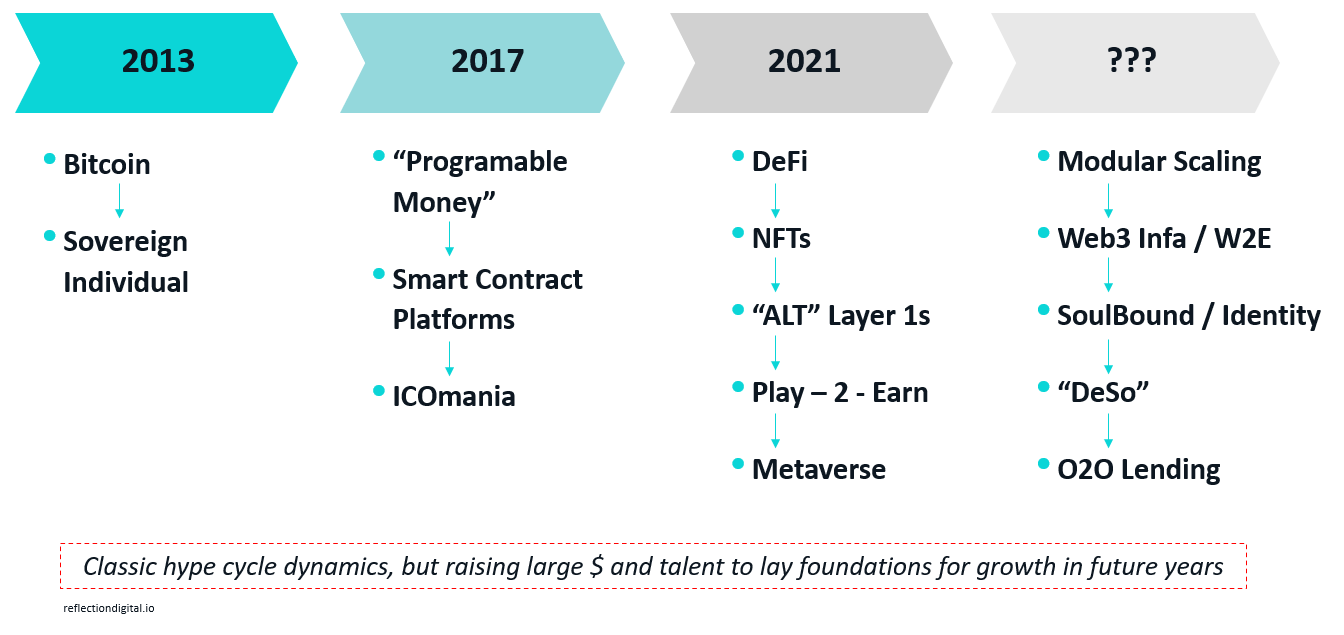

With the benefit of hindsight, these narratives reigned supreme during prior “waves”:

Wave 1: Basically “Non-State Money” (transparent, immutable, provably scarce currency beyond the reaches of the state)

Wave 2: “The World Computer” (a global settlement layer for programmable money and trustless applications)

Wave 3: “The Application Layer” (primarily the rise of decentralized applications “Dapps” on-chain - for finance, art, gaming, etc - including competing chains which offered better, cheaper user experiences of said “Dapps”)

A basket of small bets in the leading players in each of these trends during 2018 - 2020 would have proven incredibly lucrative.

So… the million dollar question: What comes next?

The Fourth Wave

Below are our predictions for the narratives set to reach a blistering screech during the next bull market. I don’t say they will “drive” the bull market because the initial catalyst will likely be macro (inflation rolling over) or again tied to BTC (halving / central bank adoption) or ETH (the merge) specific catalysts.

However, the most eye-popping returns will come further out the risk-curve, from the new narratives rising to prominence in 2023 - 2024.

Below are my predictions for wave 4:

Modular Scaling

Blockchains cannot reach billions of users without serious improvements to scaling. This admission was the primary driver behind the “Alt Layer 1” explosion1 (and implosion) of 2021 - 2022. At tolerable fees and speed, the demand for blockspace is massive.

In our opinion, the modular roadmap outlined by Ethereum and Celestia provides the best approach to scaling blockchains to millions of transactions per second while maintaining credible decentralization.

Enablers of modular scaling efforts are likely to reap the same attention in the coming cycle that the “Ethereum Killers” like FTM, Near, Avax, and Luna received in 2021 because the addressable market is so large.

And human memory is short.

I suspect many red hot projects will die out as value accrual mechanisms prove evasive and the industry consolidates around a few winners. Scaling is a long, laborious roadmap and unlikely to be “solved” in one crypto cycle. However, every new breakthrough in “rollups”, “volitions” and “data availability sampling” brings us that much closer to onboarding billions of users. And that gets people excited.

From Litecoin and Bitcoin Cash to Cardano and Dot, the search for “better scaling solutions” has proven persistent. This competition will now encompass the various branches of novel modular architectures as the competition becomes not just Chain 1 vs. Chain 2, but execution layer 1 vs. execution layer 2, consensus layer 1 vs. consensus layer 2, and data availability layer 1 vs. data availability layer 2.

The reorientation of blockchains from “monolithic” architectures to “modular” chains made up of bespoke components will reinvigorate the “scaling wars” opening up competition at the atomic level.

Web3 Infra / Work-2-Earn

To date, web3 infra has been too early. Adoption for many decentralized networks in storage, compute, and networking is insignificant. Leading projects like Helium and Filecoin have just ~US$2.7m and ~US$1.8m in monthly revenues, respectively2. In the grand scheme of cloud providers or telco’s, these numbers wouldn’t register.

However, marketplaces are notoriously slow businesses to kick start, but post inflection become forces of nature. Crypto’s killer app is unleashing incentives to coordinate disparate groups; aggregating many small actors and excess capacity to undercut centralized incumbents. In markets as sizable as storage, compute, and networking, any disruptive traction whatsoever is worth a close look.

The hype around Play-2-Earn has died down as many games’ bootstrapping phase did not lead to credible long-term economics. On the other hand, distributed infra networks like Helium, Filecoin, Arweave, or PocketNetwork provide valuable services with proven willingness to pay by customers, in massive markets, with large centralized players requiring high up front capex.

By tapping into a collection of “little guys” and incentivizing small investments in hardware (or lending out spare capacity), bottoms-up marketplaces can emerge at a superior cost point for some of our most important digital services today.

These networks have a path to compelling economics at scale. Pioneers providing “work” early in the adoption curve of winning networks will be well compensated.

SoulBound Tokens / Decentralized Identity

Decentralized identity is another narrative which has underperformed its initial promise. Hyped since the arrival of Bitcoin as a core primitive for the future of “sovereign individuals”, decentralized identity has remained stubbornly on the horizon for years.

I bet that changes this cycle.

While ERC-721 tokens saw a flash of promise in 2017 in the form of Crypto Kitties, it took another cycle for NFTs to penetrate mainstream consciousness. SoulBound tokens will take a similar arc: unlocking large markets like under-collateralized lending and on-chain advertising during the next bull cycle.

Alongside increasingly vast data sets, on-chain analytics, and ever more sophisticated algorithms, SoulBound tokens may prove the final infinity stone in credit scoring wallets, the birth of targeted advertising on-chain, and a material improvement in community-driven governance by better identifying attractive profiles for airdrops.

As someone who as spent a lot of time analyzing fintech services in the emerging world (and been persistently disappointed by the impact of decentralized alternatives), the combination of on-chain identity, hardening analytics, ease of cross border money flows, and maturation of on-chain governance / incentives should provide strong tailwinds to projects tackling financial access.

Who knows, maybe this time is different?

Decentralized Social

Web3 is inherently about data ownership; about ending the exploitative data monopolies and empowering users with better monetization avenues for the “digital work” they provide to a given network.

Improvements for scaling solutions, web3 infrastructure (like Ceramic’s data marketplace), and decentralized identity are laying the foundations for decentralized social media protocols.

This cycle saw early experimentation from industry pioneers like Lens, gm.xyz, and DeSo. However, the tooling and the user experience is far from ready for prime time today.

With compounding infra improvements, the UX may reach an inflection where users are willing to experiment with ownable profiles - especially as censorship concerns, bots, regulation, and poor creator monetization hampers Web2 champions.

Given the billions of social media users worldwide and the growing anti-platform sentiment, the spirit animals are primed for a decentralized social hype cycle in 2023 - 2024.

O2O / Real World Lending

As I outlined in a previous report, the on-chain to off-chain (O2O) lenders who make it through the bear market intact, will have a tsunami to ride in 2023 - 3024 (leading to an inevitable deterioration in credit quality and under-writing and another implosion by those prioritizing growth over sustainability as is typical in the credit cycle… crypto rails are unlikely to change that…).

However, the transparency, enhanced coordination between disparate parties, token incentives, and more efficient cross border flows, mean the existing lending market will continue to cede ground to O2O lenders in the decade to come.

The crypto rails and the off-chain rails will continue fusing in a messy tapestry of “trustless rails” and legal jurisdictions. Players like Genesis, Maple, TrueFi, Goldfinch and others are vying to become the new commercial banks - spinning up networks to underwrite credit to real-world borrowers utilizing more scalable, cross border infrastructure which can aggregate and distribute both talent and capital more efficiently than the existing banking system.

Interestingly, I suspect the biggest winners in O2O Lending will be the “decentralized” stablecoins which survive this bear market. Players like Maker and Frax are already experimenting with printing money directly into loan contracts, basically the new central bank benefitting from seigniorage, fees, and interest simultaneously. Many of these O2O networks will hit inflection (and multiple expansion) during the next cycle from their current lows as is typical of fin service businesses.

In Conclusion…

Crypto cycles come in waves. The current bear presents a compelling opportunity to hunt for the inevitable next wave for those willing to stick around.

However, be forewarned, many projects which launched tokens this cycle will never recover. Given the macro backdrop (persistent inflation, strong job metrics, Fed resolve), even good, long-term projects could see ~50%+ corrections from their current prices.

Patience (and diversification) is key.

Our prognostication is for scaling solutions, Web3 infra / Work-2-Earn, SoulBound Tokens, Decentralized Social, and Real World Lending (powered by decentralized stables) to house some of the eventual winners of the coming cycle. However, interim volatility is certain before the inevitable rise.

These themes are likely where we will direct our research efforts in the back half of the year. As always, if you are a team building in these verticals or suspect I’ve missed a compelling one, please feel free to DM me on twitter @PonderingDurian

Chin up. Spring is closer than you think :)

For newbies “Alt layer 1’s” refers to chains which compete with Ethereum to become the ultimate settlement layer for smart contracts

Token Terminal - 30 day revenue figures for Helium and Filecoin.

Thanks for the TrueFi mention! I owe you a note on some of our roadmap plans

Thanks for the TrueFi mention! I owe you a note on some of our roadmap plans