Southeast Asia - A Web 3 Juggernaut in-Waiting

Why Web 3.0 networks will supersede Web 2.0 giants within the decade

This week, we explore:

The Southeast Asian Internet Boom of 2016 - 2021

Why the Web 3.0 Boom of 2021 - 2026 will supersede it

Play-to-Earn: a harbinger of what’s to come in Southeast Asia

Crypto network penetration vs. internet adoption

Why distributed networks can play a crucial role as Southeast Asia continues to digitize before it industrializes

2010 - 2020 saw the rise of mobile applications and centralized gatekeepers on the internet. Southeast Asia was late to the party but caught up. Fast. The ecosystem growth over the last five years has been astounding.

(1) Google Temasek Bain Southeast Asia Internet Economy Report

Southeast Asia has emerged as one of the best consumer internet investment sandboxes globally with regional internet users growing 69%, unicorns jumping to ~35, and public market capitalization streaking from zero to ~US$300b. IN LESS THAN FIVE YEARS. A combination of youthful demographics, accelerating mobile utilization, limited offline substitutes, and trillions printed by central banks have put Southeast Asia on the map. Perhaps nothing illustrates this better than SEA Group.

SEA Group’s rise has been unrivaled. The company rode hit game Free Fire, superior eCommerce execution, COVID tailwinds, and a low interest rate environment to one of the most spectacular company performances of the last three years. In December 2018, SEA was trading at ~US$10 per share, by November 2021, the company had bounded ~35x to >US$350 per share - achieving a market cap of almost US$200b1.

This type of value creation is only made possible by a perfect storm: flawless execution from management, ungodly tailwinds, network effects at inflection, and access to easy, growth-desperate capital. A bit of luck never hurts either.

SEA Group benefited from them all - in spades - marrying aspects of Alibaba and Tencent’s business models - to build a regional, and increasingly global, Web 2.0 empire. SEA is by no means a singular success - with regional competitors like Grab, GoTo, Traveloka, VNG, Lazada, Bukalapak, GCash, and a host of others following behind. In short, the Southeast Asia tech scene has arrived.

With this backdrop, my thesis may seem a bit daunting: the Web 3.0 boom of 2021 - 2026 will outstrip the Web 2.0 boom of 2016 - 2021.

Let’s find out why.

Web 3.0 > Web 2.0: Super-charging Network-Effects

Web 2.0 champions like SEA Group, complemented by the digital acceleration of COVID, have done the hard work of onboarding hundreds of millions of users into the digital economy. The region now boasts one of the youngest, most digitally active cohorts of any globally:

440m digital consumers

Median age of ~30

Avg. time spent on mobile internet of ~5 hrs per day

The factors above propelled the SEA internet economy to grow from ~US$0 to >US$200b in market cap in under five years. Almost unparalleled.

I know only one ecosystem globally which has outpaced this growth…. and it did so by about 4x…

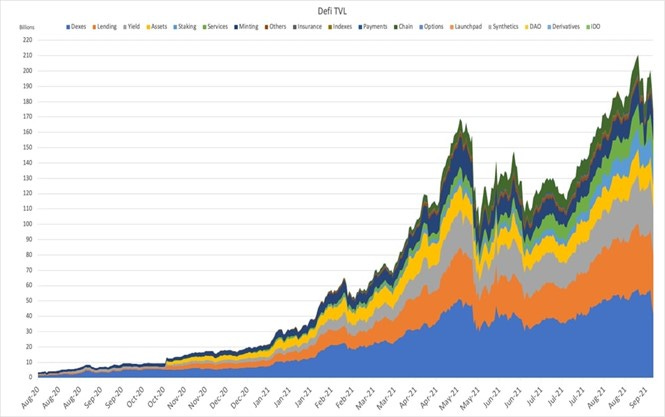

Source: QCP Capital.

From August 2020 to August 2021, the total value locked in decentralized finance “DEFI” has grown from ~US$0 - ~US$200b IN ONE YEAR. The influx of talent, the composability of opensource software, and the novel incentives are proving Web 3.0 has constructed a superior method for bootstrapping network effects.

For example, what if Grab, instead of raising billions in growth capital and spending ungodly sums on Facebook and Google ads to acquire merchants and customers to bootstrap its network, allowed users and drivers to receive small slices of equity in Grab every time they used the platform? Each time they took a ride, delivered a meal, or booked a room, a small allocation of Grab stock was delivered to their balance. Don’t you think riders and drivers would be enthusiastic to use Grab more? Don’t you think they would tell their friends and family?

This is how crypto protocols work. The individuals helping to bootstrap network effects are included in the value accrual of the network. It’s a fundamentally better, more aligned method of distributing value relative to the more extractive shareholder equity models.

This unique incentive structure - combined with the composability of opensource software - is the secret behind crypto network adoption. Emerging regions like Southeast Asia are especially well-positioned.

Many of the same trends which allowed for the explosion of Web 2.0 companies at the expense of legacy institutions will now hand the mantle to distributed networks.

Play-to-Earn: A Harbinger of the Next Decade

This year’s explosion of Axie Infinity - a hit blockchain-based game - is a prime example of what awaits on the horizon.

Axie Infinity is currently worth ~US$27b2 in fully-diluted value and was earning US$17m3 PER DAY during its peak in August. The game boasts a thriving virtual economy inhabited by users largely from emerging markets - Southeast Asia in particular.

During the lockdowns, many in Southeast Asia were struggling to make ends meet and realized they could make better wages “performing work” in the Axie economy.

New business models like Yield Guild Games (backed by a16z, FDV of US$5.4b4) emerged from the Philippines to help finance entry for players who could not afford up-front onboarding costs - kicking off a global phenomenon dubbed “Play-to-Earn”. YGG has birthed a wave of guilds across the region as well as infrastructure tooling to help onboard more participants into the crypto-economy.

Play-to-earn is hot, but by no means alone as crypto activity continues to sizzle across Southeast Asia. Alex Svanevik, CEO of nansen.ai highlights it well:

(Fire Pengus @Alex btw)

Closer to the world of atoms, protocols like XLD have emerged to bridge wages from the digital economy to pay bills, earn yield, and send cash in the world of fiat - often with lower costs relative to extractive remittance corridors, 711 cash-in / cash-outs, and pre-pay top-ups offline.

These early data points encourage our belief Southeast Asia will be home to a thriving crypto ecosystem set to inflect over the next five years. The value of Web 3.0 networks and protocols will likely overtake the market capitalization of Web 2.0 in the region this decade.

Internet Adoption on Steroids

Today, there are roughly ~200m active holders of cryptocurrency vs. an internet base of 4.7b5. Furthermore, there are just ~10m MAU users of DEFI applications. In other words, 0.21% penetration to date.

While the internet took ~14 years to go from 10m to 1b users, crypto adoption will be much faster. The telecommunications infrastructure, smart phone supply chains, data centers, and user behavior have already been built out. User adoption is now as simple as downloading an app. The 440m digitally active consumers in Southeast Asia will adopt crypto applications even faster than their Web 2.0 counterparts.

While clearly not a panacea, I believe crypto networks offer an upgraded value proposition to every day users in Southeast Asia by giving them the opportunity to participate as owners in the networks in which they participate.

Building a Middle Class… Algorithmically?

In Big Tech & Central Planning, I discussed how many economies in Southeast Asia are digitizing before they fully industrialize.

Industrialization has traditionally been the path to rising wages and middle-class life-styles, but many SEA economies are still dominated by SMEs. As more SMEs and small merchants onboard with online aggregators, they will be subject to increased competition and internet power-laws over time, skewing the distribution of incomes associated with mass industrialization:

Surveying the landscape in Southeast Asia, the pandemic is hitting the median family hard. Catalyzed by mandatory lockdowns to protect fragile healthcare systems, online adoption is sky-rocketing; aggregators serving as a life-line for access to both goods and information; a flood of offline SMEs clawing for the online lifeboat.

With digitization ramping pre-industrial maturity, big tech platforms will play a massive role in facilitating economic activity.

Given their increasingly central role, a fair question to ask is whether the incentives of big tech are aligned with the communities they serve. At the beginning stages of adoption, the answer is always the same. Yes! Merchants have a new, better way to reach consumers and consumers have access to a wider assortment of goods. The adoption on both the supply and the demand side are clear indicators of increases in value.

However, companies like SEA Group, Grab, GoTo, and Lazada are primarily responsible to their shareholders and inevitably become more extractive over time. Wheeling back subsidies once escape velocity kicks in to be replaced by ever-increasing take-rates on quarterly earnings calls. SEA Group’s take rates are public and increasing regularly… following a well-trodden path for large centralized intermediaries.

The benefits of this rent collection accrue to shareholders; which very rarely include Grab drivers or small warung or sari-sari merchants in Indonesia or the Philippines.

I’m excited about the rise of Web 3.0 because it allows for new forms of labor and investment in some of the fastest growing sectors globally - accessible to anyone with an internet connection. Network participants can become owners - retaining more value in the networks they make possible.

I’m betting during the 2020s, Southeast Asians will vote with their feet and eyeballs to spend more time in the networks they can own.

The real internet economy in Southeast Asia is just beginning.

***

Up only :)

November 2021

Coingecko (December 6th, 2021)

Token Terminal

Coingecko, non-fully diluted market cap of US$475m (December 6th, 2021)

We are social: https://wearesocial.com/sg/blog/2021/04/60-percent-of-the-worlds-population-is-now-online-2/#:~:text=Internet%20users%20have%20grown%20by%207.6%20percent%20over%20the%20past,4.33%20billion%20by%20April%202021.

Share the same views as you that distributed ledger technologies can help change how we organise ourselves and allocate capital