$Lido - Leveraging the Merge

The middleware securing our proof-of-stake future

This week, we explore Lido Finance: the middleware propelling the settlement layer of the internet.

Topics include:

“The merge” and why Lido is a “convex” option for playing it…

Diversified exposure to crypto’s emerging megatrend: proof-of-stake

Core model assumptions around ETH price, APRs, market share, take rates, etc

Valuation sensitivities: “what you need to believe”

Disclosure: the Author and Reflection Digital may own Ethereum and Lido.

Disclaimer: This is not investment advice. Crypto is risky. Please do your own research.

The Crown Jewel for the “Proof-of-Stake” Decade

Happy merge week ladies and gentlemen! For crypto enthusiasts, this is arguably the biggest week since Satoshi birthed our dear movement back in 2009.

While the Ethereum merge is rightfully grabbing the headlines, one asset is likely to benefit from the structural changes even more than ETH itself:

Lido ($LDO) - the liquid staking derivative blue chip.

LDO is basically a levered bet on Ethereum’s proof-of-stake transition. The protocol functions as middleware, reducing friction for users to participate in staking without the hassle of minimum capital requirements (32 ETH) or the technical expertise to run a validator. Lido helps users stake their assets (accruing yield) and provides a liquid-staking-derivative token in exchange. For example, Lido will take a user’s ETH deposit and allocate it to one of the many validators on it’s network. In exchange, the user receives “stETH” (i.e. staked ETH); a token representing their yield-accruing ETH position which can be simultaneously utilized in other DeFi protocols (i.e. collateral for leverage, additional yield from lendingetc). Lido effectively let’s users have their cake (staking rewards) and eat it (liquidity)!

In exchange for providing these services, the Lido protocol takes a 5% cut of all staking rewards in “assets under management”. While headquartered on Ethereum, Lido’s staking derivative solution is also active on Solana, Polygon, Polkadot, and Kusama (undoubtedly more to come), lending an element of hedging / diversification away from Ethereum as the Layer 1 wars1 continue to heat up.

In time, Lido is likely to provide diversified exposure to the “proof-of-stake” consensus (pun intended) emerging as the security mechanism of choice for next-generation blockchains. While arguably less censorship resistant, proof-of-stake chains are making a strong bid as the future of blockchain security - demonstrating more cost-effective security, less energy expenditure, and potentially broader user participation.

Lido is arguably the best benchmark for exposure to this emerging megatrend. The potential upside is material…

*Underlying assumptions to follow

The Merge

After it’s transition, Ethereum will represent >75% of the proof-of-stake market capitalization2. It is also the chain where Lido has market leadership in liquid staking derivatives with ~31% share to date (primarily competing against individual node operators and large centralized exchanges). Between decentralized, protocol-based solutions, Lido is extremely dominant:

Source: Dune analytics @LidoAnalytical

At a very superficial level, Lido’s gross revenues can effectively be modeled as: Ethereum staking rewards x Lido Market Share x a 5% take-rate. Hence, Ethereum’s transition to proof-of-stake is pivotal for Lido.

For the uninitiated, the Ethereum “merge” (expected for later this week) is the chain’s transition from a proof-of-work consensus mechanism (using electricity and ASICs to solve math problems) to “proof-of-stake” (a consensus mechanism based on financial incentives). This is how the blockchain comes to “consensus” on the current state of the ledger.

Without going into the nitty-gritty, there are a few reasons this is a big deal:

It’s an amazing feat of human engineering - a transformational upgrade in mid-flight to a decentralized global network worth >US$200b is a modern day Pyramid of Giza

The Merge is set to reduce Ethereum issuance by ~90%. Econ 101: when demand stays constant and supply is reduced, price should increase

Introduces “real yield” on a major Layer 1 asset for the first time. After factoring in dilution from new issuance, all other competitive proof-of-stake chains have negative real yields from staking. Ethereum’s real yield (along with its new ESG-friendly outlook) may entice institutional pools of capital for the first time.

It turns out, removing the high security “expenses” paid to miners (the 4.93m below) requiring expensive ASICs and electricity to secure the network and replacing it with financial incentives is much more cost-effective. Reducing this constant source of sell pressure (miners selling ETH rewards to fund expensive operations) should provide Ethereum with significant tailwinds - macro headwinds aside.

While others like Jordi Alexander fairly point out that:

The post-merge increases in ETH-staked should reduce rewards for individual stakers from this elevated ~5.1% level…

And continued bear market declines in on-chain activity will reduce projected burn significantly putting the “deflationary currency” narrative in jeopardy…

And no ETH is actually “locked-up” given the proliferation of liquid-staked derivatives, so no massive “supply-squeeze” from ETH 2.0 illiquidity

However, the facts remain:

ETH will maintain a positive real-yield for investors - (even if just 1 - 4%)

On-chain activity is reflexive and today’s forecasts arguably price “ETH” yields on depressed “earnings” (i.e. burn)

A successful merge is a positive proof-point for a world-class team executing on Ethereum’s difficult technological roadmap

The overnight change from daily sell pressure to daily buy pressure will likely, over time, prove to be a transformational catalyst for Ethereum in the months and years again.

In my opinion, Lido is one of the best ways to play this shift for ETH MERGOOOR bulls.

$Lido - Leveraging the Merge

Lido has convexity to the upside because it rides on several tailwinds aside from linear increases in Ethereum’s price:

Expected increases in the staking percentage (~12% today for ETH vs. ~77% on Solana)

Potential market share gains: ~31% on ETH today (likely capped at ~40% for decentralization purposes). However, just ~1.5% share on Solana today.

Expansion opportunities on other PoS chains (already active on Polkadot, Kusama, and Polygon, with no slowdown in the PoS chain launch pipeline)

Potential increases in take-rates from dominant position (not contemplated in this model)

Lido’s straight forward business model (5% take rate on staking rewards) makes forecasting flows a relatively straight forward exercise. As always, the devil is in the critical assumptions. Given Ethereum’s dominance, our model is most sensitive to the following:

The price of Ethereum (APR is in ETH, higher prices = more USD cashflows)

The post-merge long-term APR (current estimates ~4-5%% but will vary based on on-chain activity and staking percentage over time)

Lido’s market share on Ethereum as well as other PoS assets

Exit multiple on NTM cashflows at 5 and 10 years in the future

These crucial variables have been sensitized below to analyze the impact to returns on a 5 and 10 year time horizon.

Outside of the above variables which are sensitized, some other key assumptions (very high level model) are as follows:

ETH staked increases from 12% today to 50% in 5 years to 75% in 10 years (in line with other PoS chains: Solana, Atom and Cardano all >70% today)

Lido market share on Ethereum stays at 33% throughout (31% today)

Prices for Layer 1 assets grow at a ~15% CAGR through the projection period with ~4% staking APRs projected throughout (but sensitized below)

Ultimate 5% market share for Lido on Solana (up from ~1.5% today) and a ~3% market share on other PoS assets (only contemplates existing chains). Based on its dominate market position in Ethereum, I believe these are achievable and may prove conservative.

Aside from the above, the proportion of flows back to customers (90%) and to validators (5%) remain unchanged, leaving 5% to Lido throughout the projection period. Given the limited capital intensity of protocols, we project the majority of net positive cashflows to be used to repurchase and burn Lido tokens on the open market.

As pointed out by @0xHamz in this excellent thread, Lido’s primary “expense” of token incentives to the ETH-stETH pool on Convex (currently costing it ~6% APR on a pool of US$880m) is likely to diminish significantly over the next year as stETH becomes directly redeemable on the Beacon chain ~6 - 9 months after the merge.

I project this will bring down dilutive annual “expenses” (~80%) from ~US$50m+ today to ~US$10m in perpetuity. The positive cashflows from staking rewards can then be used to reduce outstanding supply, similar to a stock buyback.

And now…. On to the main event…

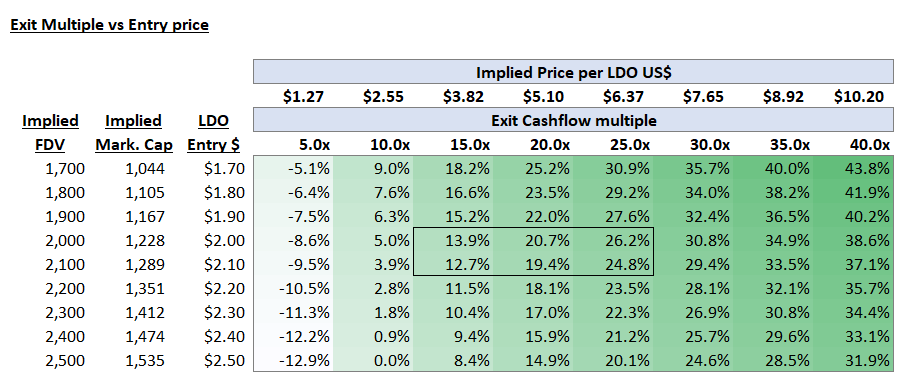

Valuation Sensitivities - 5 Year Hold (2027 Exit)

The sensitivities below outline the returns under varying assumptions for our key variables:

The price of ETH

ETH staking APR %

The exit multiple on NTM cashflows

Given crypto’s volatility, all three variables will likely fluctuate materially, potentially providing returns above and below the suggested range at various points in the cycle.

However, assuming a successful merge (>95% probability, knock on wood) and continued market leadership from Lido in liquid staking, ~20%+ returns compounded over the next 5 years take up a significant portion of the future probability curve.

Figures as of Sept 12, 2022

*Assumes 4% staking APR, US$2.05 entry, 698m tokens outstanding in 2027

***

*Assumes 20x NTM cashflow exit multiple (based on ~28% growth at exit), US$2.05 entry

***

* Assumes 4% staking APR, US$2.05 entry price, max tokens outstanding of ~800m reached in 2023 (698m at exit)

***

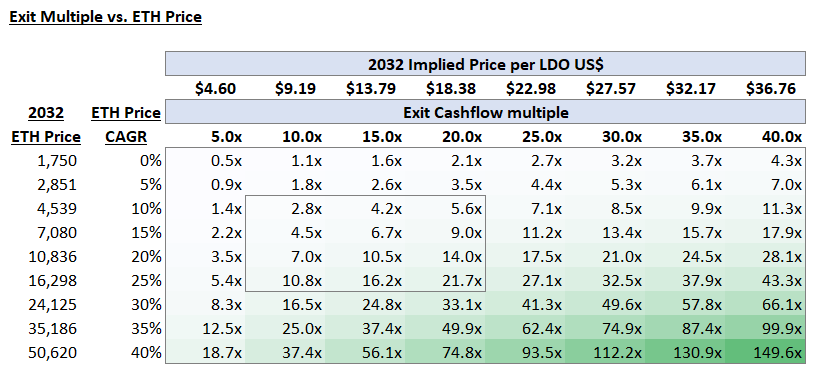

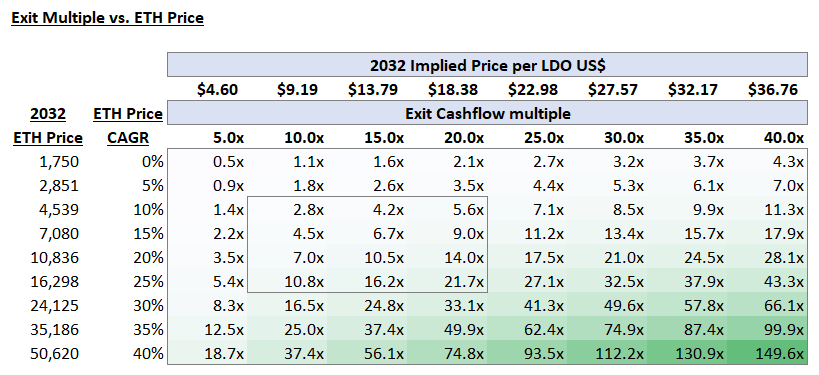

Valuation Sensitivities - 10 year hold (Exit 2032)

Interestingly, based on my projections, the real leverage kicks in during years 6 - 10. This presents an inflection point in the protocol’s expected cashflows which can then be used for “buybacks”. Assuming continued tailwinds from crypto adoption, Ethereum PoS leadership, and Lido’s continued leadership in staking derivatives, the returns provided to longer-term investors are material.

While dramatic outperformance (ETH price moons) or underperformance (ETH becomes a footnote in crypto lore) are real possibilities, the below represents my base case projections in which Ethereum adoption continues to grow steadily and Lido maintains share.

As can be seen, the greater the increase in ETH price, the more amplified the Lido outperformance becomes. While options are another way to play a bullish ETH view with leverage, Lido provides further diversification through its growing presence on challenger chains like Solana, DOT, Polygon, and others.

*Assumes 4% Staking APR, US$2.05 entry, 535 tokens outstanding in 2032

***

*Assumes 15x NTM cashflow exit multiple (23% growth at exit) and US$2.05 entry

***

*Assumes 4% staking APR and a measured ETH price of ~US$7k in 2032 (15% CAGR)

Conclusion

As opposed to the speculative vaporware often associated with crypto, LIDO is selling shovels to the gold rush. A leading middleware solution which provides real value in reducing friction for users in exchange for a cut of the staking revenues received.

This is not solely a levered play on ETH, but on proof-of-stake more broadly, presenting a compelling risk-adjusted return on what I expect to be a megatrend over the 2020s. In a world where proof-of-stake networks become the “settlement layer for the internet” as crypto enthusiasts predict, the market cap for proof-of-stake networks should be well above US$1 trillion by 2030.

The possibility for a >US$100b protocol as the leading middleware network simplifying the lives of users keen to participate is not negligible.

As Lido’s market cap today is just ~US$1.2b, this strikes me as a bet worth making.

Ethereum vs Solana vs Avalanche vs Matic vs Cosmos vs Aptos vs Cardano vs Sui… you get the picture

Includes Ethereum, Cardano, Solana, Polkadot, Polygon, Avalanche, Cosmos, Algorand