The Tower & The Square

Big Tech & Decentralized AI

Hi all -

For those that don’t follow me on Twitter, I have recently joined Delphi Digital, so unfortunately most of my new research / writing is now behind a paywall. However, occasionally some of that research gets de-paywalled:

DeAI Part 1: The Tower & The Square

I have been writing a four part series trying to tease out what is real vs. what is hype in Decentralized AI, and the introductory report is now free, so wanted to share here.

I’m obviously biased, but I believe Delphi has some of the best crypto-focused research around and am hoping my DeAI series will be one of the better resources for understanding everything happening in the stack below:

The Tower & the Square

In writing this piece, I kept coming back to themes from Niall Ferguson’s “The Square and the Tower” which traces the power dynamics between traditional hierarchies (the Tower) and networks (the Square) throughout history. While hierarchies have traditionally been the dominant forms of organization, networks have played a crucial role in shaping societies, and their rise – the Enlightenment, the American & French Revolutions, the internet, etc – have often marked profound shifts in societal organization.

The 21st century is primed for a continued struggle: the state, the corporation, the elites vs. the network, the interwebs, the proles. The hierarchy and the hivemind. The Tower and the Square.

Much of post-cold war history has been a story of the rise of networks: globalization, markets, liberalism, the internet, social media, crypto. Perhaps most symbolically, in 2021 we witnessed a social network suspend the sitting President of the United States.

However, recent years have seen the Tower reassert itself. Geopolitics are once again resurgent over economic efficiency. The tools which promised open communication have been trained inward, honing Orwellian-level surveillance of our every click. The “open internet” has fragmented into four increasingly extractive and censorious “walled gardens”.

History chronicle’s countless pendulum swings between centralization and decentralization, networks and hierarchies, anarchy and autocrats, but this time feels different. With the rapid advances of artificial intelligence, perhaps the stakes have never been higher. We are witnessing the fastest build up of computation capacity in history; a revolution almost certain to shake the foundations of society – capital vs. labor, human vocation, even what is left of our shared reality – likely necessitating a rewriting of the social contract as we know it.

And, today, the cards are stacked in favor of the Tower.

Today’s cutting edge models are fueled by two primary inputs: compute and data. Due to the tenants of “aggregation theory“, the internet has effectively balkanized into a handful of closed ecosystems, ramparts reinforced by compounding investments in a decade of artificially low rates, which have led to the monopoly cashflows and colossal data sets needed to dominate the age of intelligence. There has perhaps never been a more prime opportunity for power concentration by a small minority; a global economy of consumers, enterprises, and even governments underpinned by a few increasingly all-powerful foundational models, managed by small clusters in commanding heights.

But actually, it’s even weirder. AI IS the network. The LLMs are us. An intelligence trained on the collective output of humanity, staring back at us; the hivemind commandeered into a closed system: the square, bottled up, “trained” and redeployed back to us under the dictates of the tower. For a fee. There is something incredibly… off about the entire market structure.

And yet, the swarm is already assembling in response: a coalition of developers, investors, and users determined on prying AI from the iron grip of Big Tech and painting a vision for user-centric intelligence.

The following report is a layman’s exploration into the AI value-chain: a peek into the awesome resources being deployed by the hyperscalers and the emergent decentralized AI ecosystem, assisted by cryptography & distributed incentives, aiming to present a viable alternative.

Are we heading for a world of a few 10 trillion parameter models governed from four thrones in the Pacific Northwest? Or are we destined for a tapestry of models in the millions underpinned by open source communities and collective ownership? An internet of agents? A Hivemind.

Of history’s countless concentrations and diffusions of power, the next chapter between the Tower and the Square is perhaps it’s most consequential.

Your Size is Not Size

Google, Amazon, Meta, Microsoft, and Apple are currently sitting on over US$400b in cash-like assets (now clipping >5%). Furthermore, their core businesses are throwing off the equivalent of >1.5% of GDP in operating income each year. The race for AI supremacy is just getting started.

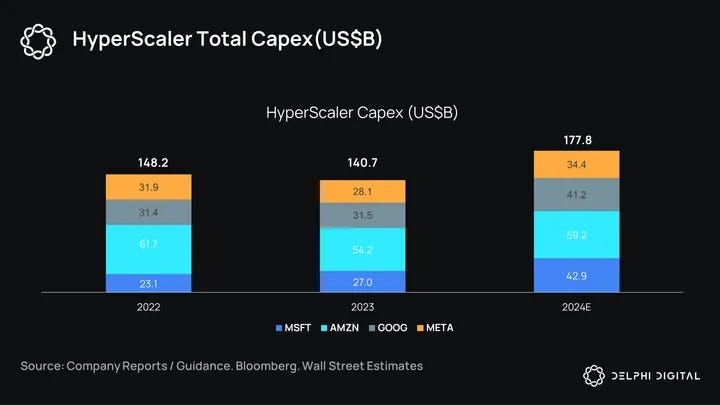

The four hyperscalers (above less Apple) have combined to spend US$467b in capex over the last three years…

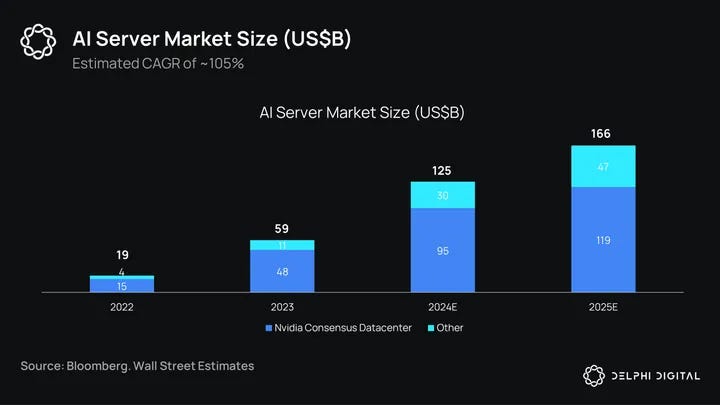

With recent analyst estimates expecting >$1 trillion in combined outlays over the next five – an absolutely mind-blowing number in capex spend, passing all but 18 countries’ GDP levels. A significant portion of this spend is going straight to the AI server market, dominated by Nvidia.

To put these numbers in perspective, the AI server market is set to eclipse the entire CPU market by ~40% in 2025, US$166b vs. US$120b. The investment in AI datacenter capacity is the largest outlay in the history of compute by a wide margin.

Two scenarios come to mind: 1) the cloud boom of the 2010s which was met with robust demand as companies of all sizes recognized the benefits of outsourcing core IT infrastructure or 2) the US$90b in fiber capacity laid during the telco boom much of which remains unutilized even today.

Looking at the market size for… intelligence… my hunch, and clearly the C-Suite of the hyperscalers, is for these massive outlays to be met with robust demand and – dare I say “oligopoly-esque” – returns. US corporates are sitting at ~14% in cash-like assets and margin levels not seen since the 1980s. Every earnings call and board meeting is rife with existential AI disruption discussions. The demand will come.

Investments in cloud infrastructure started out with negative margins and have since risen into the 60 – 70% gross margin range as the market has consolidated around three primary vendors servicing a Cambrian explosion of applications and cloud transitions.

The setup for GenAI feels very similar.

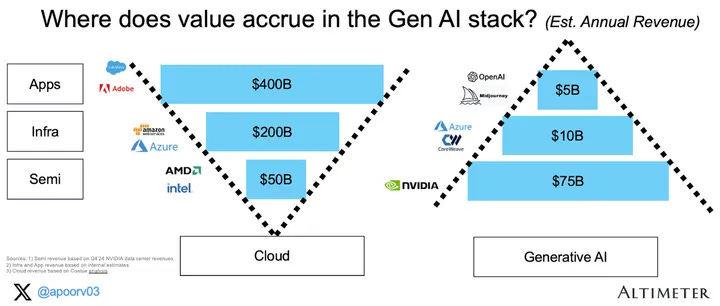

In a recent piece, Apoorv Agrawal outlines the discrepancy in the GenAI value-capture at different layers in the stack vs. the current state of cloud. The outlays in cloud eventually led to ~US$200b in cloud revenues powering a further ~US$400b revenue app ecosystem on top.

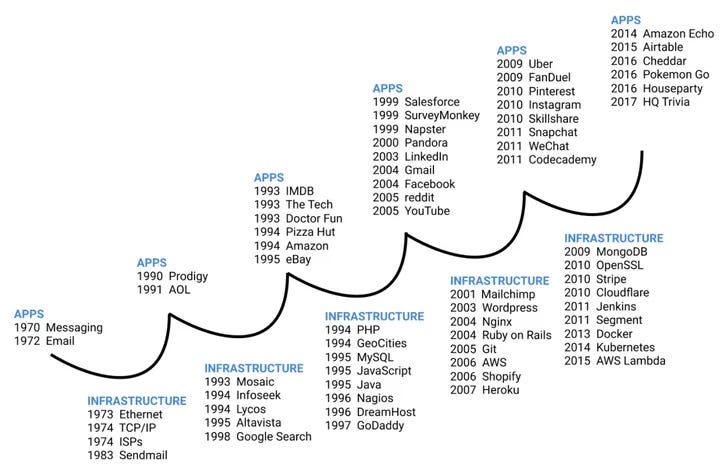

This follows a familiar pattern outlined by Union Square Ventures where infrastructure outlays lay the groundwork for the ensuing application boom.

Source: USV blog.

We are still very much in the infrastructure build out phase of Gen AI with the vast majority of profits to date accruing to Nvidia and the semi layer of the stack, but value capture is likely to shift up substantially over time

Not only cash rich corporate IT budgets but also a significant portion of the ~US$600b in VC dry powder will find their way into AI server spend over time, not to mention AI-focused sovereign funds like those of Saudi Arabia and Abu Dhabi both announcing targets for ~US$100b in AI focused investment vehicles to deploy in the decade ahead.

Like cloud, there is increasing reason to believe much of the middle layer of the Gen AI stack will be dominated by a few major players who have combined the capital, talent and data to hone amazingly capable infrastructure and models which will be rented out: intelligence-as-a-service.

Paradox of the Open Web (Consumer Aggregation)

One of the more prescient paragraphs I have read regarding the evolution of the internet came from an interview with famed American author David Foster Wallace at the tail end of his Infinite Jest book tour in 1996.

“…That Interlace will be this enormous gatekeeper. It will be like sort of the one publishing house from hell. They decide what you get and what you don’t.

Because this idea that the Internet’s gonna become incredibly democratic? I mean, if you’ve spent any time on the Web, you know that it’s not gonna be, because that’s completely overwhelming. There are four trillion bits coming at you, 99 percent of them are shit, and it’s too much work to do triage to decide.

So, it’s very clearly, very soon there’s gonna be an economic niche opening up for gatekeepers. You know? Or, what do you call them, Wells, or various nexes. Not just of interest but of quality. And then things get real interesting. And we will beg for those things to be there. Because otherwise we’re gonna spend 95 percent of our time body-surfing through shit that every joker in his basement—who’s not a pro, like you were talking about last night. I tell you, there’s no single more interesting time to be alive on the planet Earth than in the next twenty years. It’s gonna be—you’re gonna get to watch all of human history played out again real quickly.”

-David Foster Wallace (“Although, of Course, You End Up Becoming Yourself” by David Lipsky)

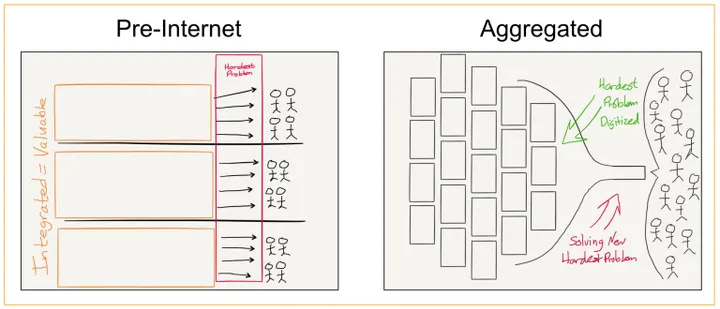

The internet evolved into propriety applications and ecosystems not out of malice but because the limiting factor is not content but human attention (shout out to @mrink0). Today, real scarcity online is found in effective curation – in sorting through the endless bits to find what is actually relevant to the user. Per Ben Thompson’s aggregation theory, capturing demand onboards its own supply in a world of zero marginal costs.

The truth is that Google and Apple and Meta and Amazon and TikTok and Tencent have succeeded in attracting users because they are expert curators: serving us – out of the trillions of bits on the web – those we find most relevant. And this positioning – as “wells” or “nexes” or “gatekeepers” – has allowed them to extract greater amounts of capital and data – the two assets most essential in our new AI “scaling wars” in the era of Transformers.

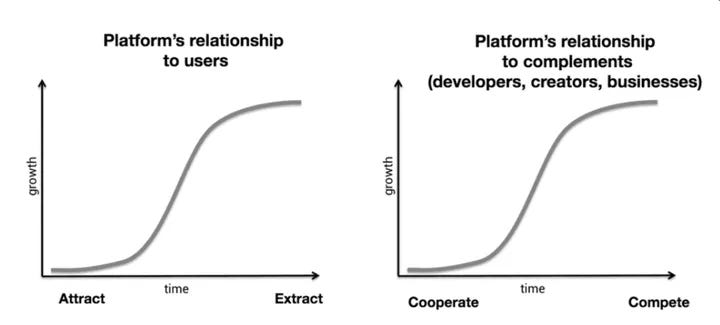

We can bitch and moan all day about the App store’s 30% and Google and Facebook’s ad duopoly and Amazon driving mom and pop’s into the dirt – and yes, it’s true that closed networks move from open to extractive over time…

Source: Chris Dixon: “Why web3 matters”

And yet, we use them. We use them because the alternative is chaos: saving me time, protecting against fraud, ensuring seamless payments, surfacing material most relevant to my desires.

Why should we expect AI to end up any differently?

In a way, AI is the ultimate aggregator. Amazon, Google, Booking.com – and potentially TikTok & Reels – all rolled into one giant front-end. The user’s interface to the internet. The best tool – closed or open – which most effectively matches user intents with the desired information or action will win. Convenience has proven time and time again to trump ideals in the marketplace.

Concentration appears set to continue, and it’s not limited to the consumer side…

To continue through the remaining 40+ pages… please continue at the link below

DeAI Part 1: The Tower & The Square

Also, if you read this report and are keen to learn more about a subscription to Delphi’s Research, please drop me a DM on twitter or simply use my referral link when subscribing.