Excited to announce Reflection Digital has launched and is currently in the market. Many thanks to the team members, advisors, and investors who helped us get off the ground.

With that, as a self-diagnosed wordcel, I must be true to my nature and pick up the pen once more.

This week, we explore:

The terminally ill long-term debt cycle

Trapped central banks and the coming decade of financial repression

Bundling & Unbundling: Finance’s infrastructure overhaul

The shortage of dollar funding in crypto and the drivers of structurally higher yields

Why stablecoin supply (or monetary equivalents on-chain) should grow another 100x this decade

In my view, it’s quite clear we are approaching the tail-end of a long-term debt cycle as coined by Ray Dalio.

I’m not saying there will be a system wide restructuring tomorrow or even within the decade, but central banks do appear to have backed themselves into an increasingly inescapable corner.

Today’s low growth, high debt / GDP ratios, rapidly expanding money supply, and yield curve control are textbook indicators for a crumbling debt cycle - historically lasting 70 - 80 years. Considering the last full-scale restructuring of the financial system happened in 1944 with Bretton Woods, we appear to be right on schedule.

As showcased by market reactions to the Fed’s impending 4 - 6 hikes this year, King Dollar is still very much on the thrown. Reserve currencies are notoriously sticky as every debt issuance represents a future buyer of the currency1. However, any serious investor with multiple decades of runway has to start thinking about the accelerating debt burdens globally and what the inevitable reset will look like.

I’m sorry but any student of history should have disdain for modern monetary theory. While they have surprising staying power, no reserve currency in history has proven to possess infinite kicks of the can.

Expanding Deficits & Increasing Debt Burdens

To combat the impact of the coronavirus in 2020, governments, companies and households raised US$24 trillion bringing the global debt total to an all-time high of US$281 trillion2. At the end of 2020, global debt spiked to an unprecedented 356% of GDP3. The monetary expansion from quantitative easing which started in the wake of the 2008 financial crises has swollen the balance sheets of the Federal Reserve, the Bank of Japan, and the European Central Bank to >US$24T4. We are addicted.

In the U.S., the broad money supply (M2) has averaged a non-trivial ~6% growth since 2000 but rose to an unprecedented 27% in 20205. The Fed’s balance sheet has swollen to >US$8 trillion, with a federal debt-to-GDP ratio of ~130% and a total debt ratio of ~296%6. The U.S. is clearly not alone with the debt-to-GDP levels in Europe, China, and Japan at 195%7, 271%8, and 419%9, respectively.

With such elevated debt levels, the Volcker playbook of the 1970s to tame inflation with 11 - 12% interest rates is not in the cards. Governments today have four choices:

Austerity

Restructuring of debts

Faster GDP growth

Devaluing the currency

Austerity often slows growth to the point of hurting debt / GDP ratios further. Restructuring would likely be catastrophic. Elusive GDP growth is why governments are in this predicament. When faced with similar challenges historically, governments inevitably chose to debase.

The current scenario: inflation > treasury yields is by design. Sure, most central banks do not want a 5%+ spread between CPI prints and the 10 year treasury which is why Jerome Powell is slamming on the breaks to calm mass discontent over rising grocery prices. However, having inflation above treasury yields is a feature not a bug. It’s the only way to deal with such a large debt burden. Central banks across the globe will follow the same playbook.

Similar to the 1940s, the 2020s will be marked by financial repression - inflation rates above treasury yields and a loss of purchasing power for anyone in cash, savings, treasuries or bonds.

Investors will either accept a loss of future purchasing power or will be forced ever further out the risk curve.

Fortunately, amidst this gloomy backdrop, a parallel financial system is emerging. A chance to rebuild a fundamentally broken system with 21st century tooling and provide investors with an escape from the debt-laden, low-return environment of the existing system.

At least for now.

Bundling & Unbundling: The Infrastructure Overhaul

Blockchains have emerged as the new computing frontier for ambitious entrepreneurs. Every 10 – 15 years, we tend to see a new cycle. Like the PC, the internet, and mobile revolutions of the last four decades, blockchains are unlocking new properties for entrepreneurs10. Looking at these new properties – opensource, global, composable, immutable, and transparent - it’s easy to see why many of the early applications have been in financial services.

As coined by Jim Barksdale, “the only way to make money is bundling and unbundling”.11

Decentralized finance (“DeFi”) is rapidly unbundling traditional financial services at exactly the time the system is sagging under an enormous debt load and in dramatic need of an infrastructure overhaul.

DeFi is a catch-all for the collection of novel opensource protocols - a.k.a. “money legos” - being released daily which offer access to automated financial services - payments, lending, derivatives, etc - without the need for a familiar intermediary. Financial services as peer-to-peer networks managed by money robots governed by members of the network.

This new “internet of value” is proving to be a one way black hole for talent and capital from the traditional world of suits and 1970s tech stacks - exploding from ~US$10b in value locked to ~US$250b… just last year.

Surprisingly, this exploding ecosystem has a shortage of dollar-funding.

Everywhere else on the planet suffers from a deluge of capital - sloshing into every nook and cranny to escape the looming financial repression after a decade of quantitative easing. Yet, the crypto ecosystem, the fastest growing, most innovative industry on the planet, suffers from a structural shortage of dollars.

What gives?

Why are Yields Higher in DeFi?

In a world of artificially low-yields, the traditional 60 / 40 portfolio is dying. Why would you invest in bonds that are GUARANTEED to lose you purchasing power over the next 10 years?

Amidst this backdrop, capital allocators will need to reexamine their debt portfolios - ideally for assets with a similar volatility profile but with boosted yields to help meet their growing obligations - to universities, foundations, pensioners, claims payouts etc.

Decentralized finance is emerging at just the right time to offer a solution.

By converting US dollars or other fiat into US dollar-backed tokens on the blockchain (“stablecoins”) and providing USD-denominated liquidity to the “money robots,” investors can meaningfully boost relative APRs.

Why you ask? Why does such a simple arbitrage exist in an industry as cut-throat as financial services where Ken Griffin can pay up to co-locate Citidel servers inside the exchanges?

“How are the yields this high? Why is there such a spread over traditional finance?”

“Isn’t this just a sign of massive underlying risks?”

“Won’t this simply be arb’d out as larger capital pools enter the space?”

All good questions and fair concerns, dear reader. I look forward to accompanying you on your journey from skepticism to intrigue to exposure.

The Drivers of Higher Yields

Structural Shortage of Dollar Funding: Despite the higher yields available, the on-ramps into decentralized finance are filled with friction. Banks have been reticent to work with crypto companies, the awareness among investors is low, regulation is evolving, and the institutional infrastructure is still being built. Despite the significant demand for dollar funding, the supply has been constrained, leading to attractive rates for lenders and liquidity providers.

Providing liquidity in decentralized finance (e.g. “yield farming”) represents a new paradigm in bootstrapping early networks - increasing variable yields. Instead of spending money on Facebook for customer acquisition, protocols incentivize users directly with slivers of ownership (i.e. tokens) for early participation. By being a relatively early liquidity provider to stable, growing projects, farmers receive a combination of transaction fees generated by the protocol as well as token distribution rewards - accentuating the “yield”.

There are additional layers of risk for which investors should be compensated. Let’s face it, the space is only ~2 years old. DeFi is not “Lindy”. In addition to familiar credit and market risk, investors must contend with new security risks of smart contract exploits as well as underlying stablecoin risks which are often more analogous to non FDIC-insured money markets than bank deposits. That being said, the over-collateralized and automated liquidations of most loans help reduce credit risk.

The last reason is timing. We are still early. Will yields come down? Of course. Will it happen overnight? No. By the time Blackrock, Vanguard, Japanese Insurers, and Sovereigns are deploying trillions into yield farming strategies and yields compress to match the traditional system, the asset class will be worth >US$50 trillion. Surely a good wave to ride.

Overall, it strikes me as a structurally attractive trade: taking money-market credit risk and the occasional smart contract exploit - to generate ~15% stablecoin return with a relatively muted volatility profile?

No wonder stablecoin demand is booming.

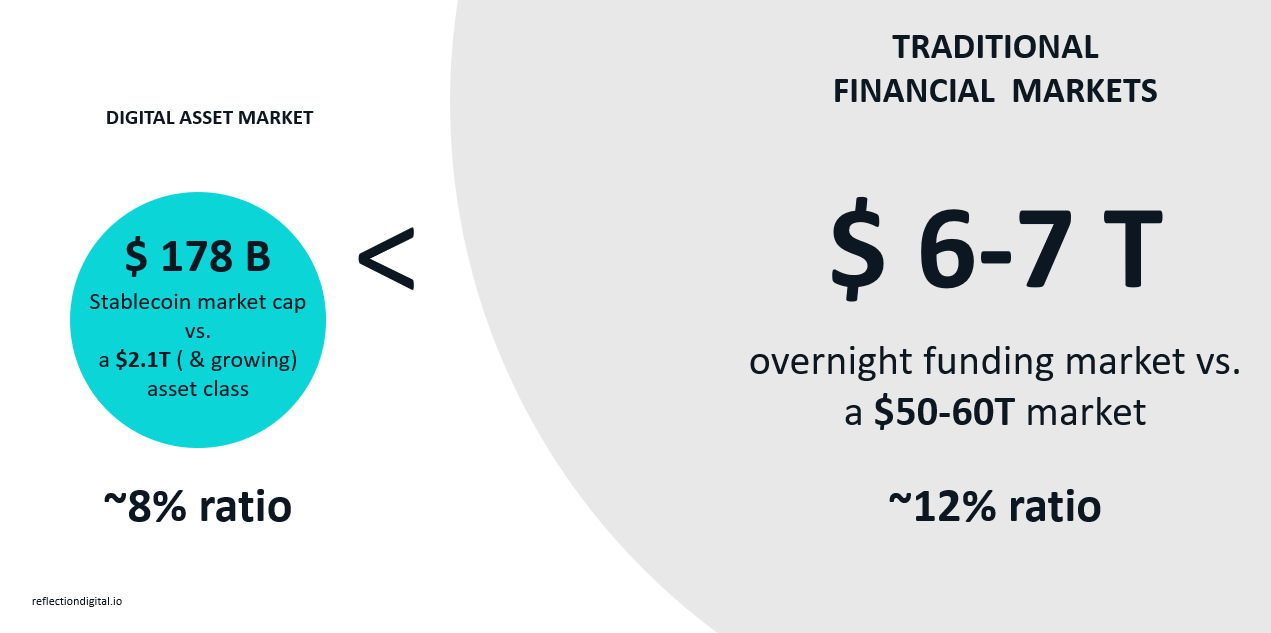

I would genuinely be surprised if this chart does not 100x again by the end of this decade.

Dollars are chasing yield and given the artificial rate environment, “high-yield” debt has become something of a misnomer…

DeFi on the other hand has a structural shortage of dollar funding despite being the clear growth engine of financial services this decade - likely to dramatically expand the TAM.

Sizing the Opportunity

Last post, I provided some user penetration statistics. The gest: ~10m active DEFI users today vs. an internet base approaching ~5b.

To supplement with a top down view, John Street Capital wrote a short book on the topic including market sizing data points which DeFi is set to disrupt in the coming decade:

· Alternative Assets: ~US$14 trillion

· Banking & Digital Banking: ~US$9 trillion

· Gold: ~US$10 trillion

· Insurance: trillions annually in premiums with trillions in market cap

· Payments: revenues >US$3 trillion in 5 years

· Commercial Real Estate: US$17 trillion in the US alone

· Trading: trillion of dollars of equities, fixed income, and derivatives traded per year

North of >US$50 trillion.

Networks worth ~US$50 trillion will need orders of magnitude more than the current ~US$180b in stablecoin liquidity to bootstrap themselves.

Like it or not, the hyper-bitcoinization thesis seems a ways away. Most folks still like denominating wealth in stable assets which match their expenses and their tax bills. Dollars, Euros, Yen, RMB. The explosion of stablecoins on-chain demonstrate most crypto users are not devoted anarchists willing to renounce national monetary sovereignty for Austrian hard-money principles, but instead are rather pragmatic about retaining purchasing power over time.

However, because crypto empowers individuals via encrypted networks, aggregated capital pools have been late to the party. The same peer-to-peer networks which disrupted media and information services have come to finance and institutions have been caught flat-footed; plagued by a lack of infrastructure, regulatory uncertainty, and a classic innovators dilemma.

In 2022, massive pools of capital will grow tired of negative real rates and will start to look for greener pastures. The structural shortage of US dollar funding in crypto presents a compelling opportunity for early adopters.

With this macro backdrop, there are very few other places to hide.

Byrne Hobart on Coindesk: https://www.coindesk.com/markets/2020/06/29/why-bitcoin-will-take-a-long-time-to-dethrone-the-dollar/

International Institute of Finance - 2020 Figures

Ibid.

Atlantic Council QE Tracker. https://www.atlanticcouncil.org/global-qe-tracker/

Lyn Alden Investment Strategy: The Ultimate Guide to Inflation

Fidelity Macro Director - Jurrien Timmer - on Financial Repression

Combination of 100% public debt to GDP ratio and 95% private debt to GDP ratio: https://www.ceicdata.com/en/indicator/european-union/private-debt--of-nominal-gdp, https://ec.europa.eu/eurostat/documents/2995521/11563191/2-22072021-AP-EN.pdf/282c649b-ae6e-3a7f-9430-7c8b6eeeee77?t=1626942865088

China’s National Institute for Finance and Development: https://www.scmp.com/economy/china-economy/article/3135883/china-debt-has-it-changed-2021-and-how-big-it-now

Fidelity Macro Director on Financial Repression: Jurrien Timmer

Paraphrasing Chris Dixon - Crypto Partner a16z

Ben Thompson paraphrasing Jim Barksdale: https://stratechery.com/outline/bundling-and-unbundling/