O2O Lending - DeFi's New Frontier

A Deep Dive into the On-Chain to Off-Chain Lenders Aiming to Replace Banks

Hey Fam -

Excited to provide subscribers an early look at the latest Reflection Digital research piece on On-Chain to Off-Chain lending protocols.

A deep dive into the protocols vying to replace banks as DeFi’s tentacles slowly seep outward into the world of atoms.

Please enjoy.

A taste of the report for the lazies who do not wish to click through….

INTRODUCTION

There is a weird ritual which occurs every few years on crypto twitter (CT). At the tail end of each cycle, an unsuspecting Tradfi financier will make a splash, stumbling upon the wonders of web3 and proclaiming his novel quest to fund the next decentralized Uber or AirBnB. Without fail, crypto OGs will dutifully ridicule said take to the nodding approval of the influencer’s groupies.

Said VC will then retreat in shame, and the vanguards of crypto twitter will sheath their whack-a-mole clubs, waiting patiently for another unsuspecting victim three years hence.

It’s about as consistent as the post-halving pump at this point.

Espousing decentralized networks as a panacea for existing consumer internet applications is synonymous with wearing a large sign which reads: “Hi, I’m new here 😊”.

The old guard does not tolerate sloppy thinking and, unfortunately, the ridicule is not without merit.

In 2017, aside from the fanciful “decentralize all the things” narrative, I vividly remember “revolutionizing the supply-chain through blockchain technology” being the premise of every third crypto podcast (inevitably ICO pump narratives inhabiting the other two). Blockchain’s immutability, transparency, and credentialing nature was to be a game changer for the global supply chain. Enhanced quality control. Real-time tracking. Verification of ESG compliant suppliers. Increased efficiency.

The dream now seems distant and cold.

In hindsight, the clear problem is on-chain data is only as trustless as it’s inputs. Garbage in, garbage out. While blockchain is a reliable arbiter of truth on-chain, ensuring accurate inputs from external sources is difficult. Under these constraints, its often cheaper and more efficient to use a centralized database.

In short, you can understand my skepticism when it comes to on-chain to off-chain “O2O” models. There is nothing quite like having a not insignificant portion of your net worth incinerated for a lesson to be branded into your subconscious.

Despite this, I once again find myself coming back to the well. The O2O siren song gracing my ears once more.

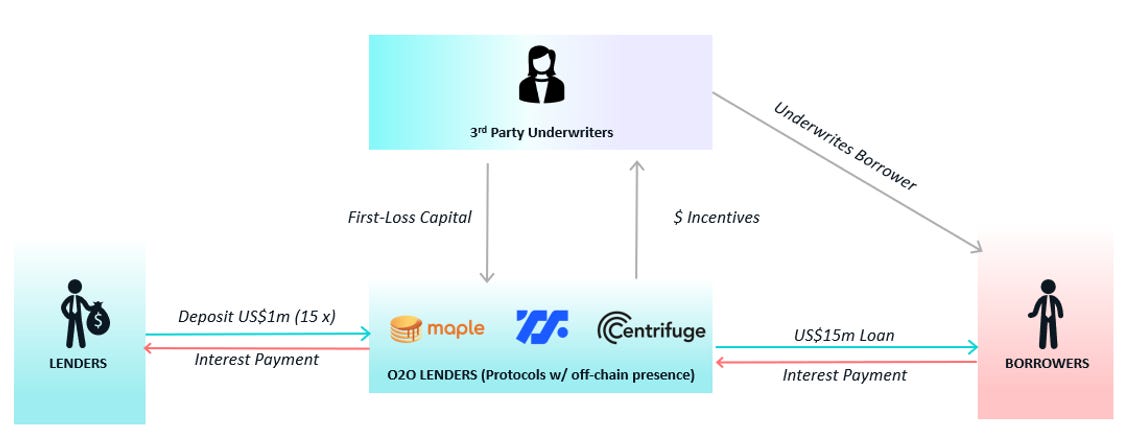

O2O lending is the primary culprit. Pools of capital congregating in DeFi to fund institutional trading houses, SME loans, telephone bills, or even Tesla repair centers in the real world. USDC flows into productive, meatspace outlays.

The online-to-offline crypto stack is evolving. The players seeing early success have realized a purely decentralized model is impractical. Real world businesses need an organization to face, contractual guarantees, and legal frameworks to cover unpredictable scenarios in the world of atoms. English common law is an amazing innovation which shouldn’t be dismissed so quickly by techno-utopiates. Code is a compliment not a replacement for legal precedent.

Step by step, we are seeing pragmatic models gain traction. Models which recognize both the benefits and real constraints of DeFi merging with the real world; mitigating risks with traditional legal reassurances but still leveraging crypto’s ease of cross-border capital aggregation and novel incentives to build challengers.

The leading O2O models today are quasi-Frankensteins. DeFi meets CeFi. Digits meet Atoms. Trustless meets Trust. Code meets law.

While cypher punks may shake their fists in frustration, the collision of crypto networks and nation-state regulators was always going to settle into some sort of uneasy truce.

For better or worse, the future of france[1] will not solely be on-chain money robots dutifully churning out block after block, but instead an interlaced tapestry of rigid legal structures, fluid protocols, and imperfect humans.

DeFi is bound to grow exponentially. The S-curves are enshrined. However, to reach its full potential, the ecosystem will have to interface with the outside world. And the outside world is messy.

At Reflection Digital, we put together this report to explore some of the leading players, competing mechanisms, and crucial pieces of infrastructure enabling DeFi’s foray into the off-chain hinterlands.

[1] Not a typo. Get with the times dear ser. Memes are eating the world