Monopoly Money

A Deflationary Asset Bubble & the One-Eyed King

This week, we explore:

The Great Depression 2.0 vs Money Printer Go Brrrr

The Wall St vs Main St Decoupling

Robinhood Day Traders vs Stan Drunkenmiller

The One-Eyed King vs the Field

The Public vs Private Divide: monetary regime inequality jumps to business

Monopoly Money

At the end of last week’s post, I wrote what I considered to be a throw-away line regarding emerging market consumer internet:

“In our new deflationary world, it is the one, certain place investors will find growth”

I was surprised to get pushback from readers. In 2020, with unprecedented monetary stimulus, several of you pointed out “the printing of US$4 trillion sounds a lot more like we are heading into an inflationary environment.”

Intuitively, that is logical. But like anything in 2020, it’s nuanced.

Given the craziness of the last ~4 months, I wanted to present my take on macro dynamics, capital markets and why it matters to Emerging Asian tech. Given the pre-eminence of the US dollar, the depth of the U.S. capital markets, and its centrality to the global financial system, we must start with the root actor first:

The U.S. Federal Reserve.

***

Despite shocks to the supply side, COVID is a larger hit to aggregate demand. Consumer confidence and willingness to spend is drying up and the Fed is trying to grease the engine with easy credit. The virus is inherently deflationary, and the monetary response is the offset - an attempted inflationary counterbalance.

The truth is, this is not new. We have been in a deflationary environment since the Global Financial Crisis of 2008. Despite unprecedented government easing, and near-zero interest rates, central banks have routinely undershot inflation targets.

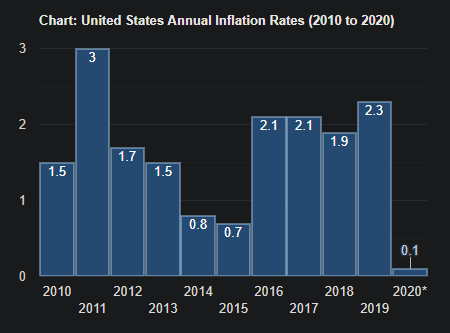

The Federal Reserve has come in below the 2% inflation target in eight of the last twelve years since the GFC (2009, 2010, 2012, 2013, 2014, 2015, 2018, and 2020*). And, despite the Fed expanding its balance sheet by a record US$3 trillion since Feb 26, 2020 inflation is charting towards zero.

While the Fed is the most important actor, it is far from alone in its crusade against deflation…

I think you get the idea. Any country with capacity for stimulus is following suit.

Despite a tsunami of money being injected into the financial system, the price of goods and services is not rising.

What gives?

Wall St vs Main St: the Decoupling

As the old saying goes, you can lead a horse to water, but you can’t make it drink.

The same is true of consumers.

While the US economy has been hit hard by the virus, the current deflationary environment is derived from an amalgamation of factors going back over a decade which has made the US consumer less resilient.

From globalization and the outsourcing of American jobs, to a housing bubble, to accelerating automation & stagnating wages, to leverage traps in education & healthcare, to a swelling national balance sheet weighing on growth prospects, the American consumer is increasingly fragile.

The road back from the GFC has been a slow recovery - marked by slow growth, lower productivity, increasing inequality and depressed work force participation.

And then COVID.

No wonder the Fed cannot hit its inflation targets.

In the current environment, the average person is much more conservative. Savings increase (or in the west, credit expansion reverses) and consumption falls. Inequality is a factor as wealthy people tend to spend the same on daily essentials, so purchases do not change despite prices coming down to incentivize demand. As prices stagnate or even decrease, already cautious consumers are further incentivized to delay spending.

After studying the 1930s and 2008 financial crises, the Fed is desperate to avoid this deflationary spiral, and has learned the best way to avoid it is to flood the market with liquidity.

These trillions need to go somewhere. However, as shown by the lagging inflation targets, it is not finding its way to goods and services - it is not stoking consumption in the real economy.

In this uncertain, deflationary environment, consumers will look to protect their purchasing power to be used at a later date. Real interest rates are now negative given Fed policies, so wealth is stored away in assets that can protect future purchasing power - the most liquid of which are stocks and bonds.

Thus we do not see rampant inflation in prices for goods and services, but we see it in asset prices. Despite the worst economic environment since the Great Depression, asset prices - led by large tech stocks - have rallied with the S&P 500 once again approaching all-time highs:

We are in uncharted waters. A deflationary super-cycle meets the world’s largest stimulus package. The horse has been brought to the river but is not drinking. Instead, he fills his seemingly bottomless water tank in preparation for what is likely to be a long road through a barren desert.

But… how much room is left in the tank?

Like the answer to most interesting questions:

It depends.

Jerome Powell & his Band of Merry Men

Despite exceptionally frothy market valuations contrasted with the depressing economic reality, the asset bubble has room to run.

Jerome Powell has indicated a “whatever it takes” stance to support the economy through turbulent times. After witnessing the speed and size of the first intervention, investors believe him.

“Don’t fight the Fed” has emerged as a rallying cry. The emergent army of Robinhood day traders leading the charge; the stock market a virtual Las Vegas standing in as surrogate for lost sports gambling.

While the backdrop certainly looks like 1929, the Fed’s voicing of continued support is effectively acting as a market backstop - creating a moral hazard in the equity markets.

The underlying logic:

The Federal Reserve has essentially one tool to prevent a depression: liquidity

As we have learned, since 2008, this increased liquidity tends to end up inflating asset prices as opposed to goods and services

The Fed will step in and “support the economy” whenever things get bad

Given inflation is in assets as opposed to CPI, there doesn’t seem to be a reason for the Fed to change course

Investors are looking at the impact of quantitative easing to stock returns over the last 10 years despite relatively sluggish global growth, seeing an even larger stimulus and placing bets accordingly. Millennials - realizing the current monetary regime has boosted the value of their parent’s homes and assets beyond their reach are now eager to climb aboard. The FOMO is real as the gaping divide of inequality continues to widen - they clamor aboard, inflating already precariously over-valued stocks.

Surveying the craziness, a slew of leading investors from Stan Drunkenmiller to Howard Marks have come out on record saying the “risk-reward in stocks is the worst [they] have ever seen”. Clearly, the smart money is on the sidelines.

BUT… (The devil’s advocate in me can’t help himself)

But… What if the day traders are onto something?

The Fed seems committed to support the economy within the bounds of its dual-mandate:

“Maximum employment, which means all Americans that want to work are gainfully employed and

Stable prices for the goods and services we all purchase”

Given unemployment is high and inflation is not flowing to goods and services (but assets), there is no reason for the Fed to adjust policy. Furthermore, given the aging demographic profile in the US, there is increasing political pressure to prop markets up from their typical cyclicality.

What if the monetary pigeonhole we have found ourselves in (i.e. slow growth, deflation, printing, asset inflation) is just the beginning of the largest asset bubble of our lifetime?

Remember five years ago when it was “too late” to get into Facebook? Google? Amazon?

What if the last leg of the extended 70 year credit cycle - the government-led leg with “unlimited” liquidity - makes the dot-com bubble and housing bubbles look like ant-hills?

What if…on our way to the potential demise of the U.S.-led financial system as we know it…

Asset prices are just getting started?

The One-Eyed King

To quote 15th Century Dutch Philosopher Desiderius Erasmus, “in the land of the blind, the one-eyed man is king”.

In 2020, the U.S. is the one-eyed king.

Despite poor fiscal and monetary practices, near-zero interest rates, and an increasingly ailing balance sheet, demand for USD and treasuries remains strong. There is simply no where else to go.

Japan has been stagnating since the 90s with a Debt / GDP ratio of ~230%. The European Union is following suit and the very existence of the monetary union in question. There is a high probability the Euro doesn’t see 2030. The sterling is a relic from a colonial past and is rapidly being weaned from reserves. While China has a healthier government balance sheet, there are strict capital controls for a reason. It’s doubtful China will rapidly open its financial boarders after the strong outflow pressures witnessed in 2015 and 2016. The rule of law is still too arbitrary.

That leaves…. the U.S.

Even with the record stimulus, there is an “insatiable demand” for US treasuries. From the FT on a possible additional US$3t in US government borrowing:

Financial markets have so far had little difficulty in digesting the supply, with Treasury yields ticking slightly higher but still hovering close to record lows. The 10-year note now trades at 0.67 per cent, roughly 1 percentage point lower than where it began the year…

There is a seemingly insatiable demand for US dollar debt. There is little to suggest that the Treasury will have any issue funding [the government]”

Seemingly every issuance is over-subscribed. Foreign governments are clamoring for US-swaps further embedding its status as the global reserve currency. As long as that demand is there - the insatiable gorging on US treasuries - the Fed can continue printing which means the credit bubble has room to run.

Will this cycle end? Clearly. As Ray Dalio has traced fanatically, every empire and respective reserve currency has followed the same arc:

And I fear the US-led arc is heading towards its peak.

However, the Robinhood Day Traders are betting there is room to run. The insatiable demand for treasuries will continue. A bet that the One-Eyed King has more than a few years left to reign.

I’m not saying I know what will happen to stock prices in the next 3 - 6 months.

However, looking at the reinforcing cycle: debt increases -> slowing growth -> lower consumer confidence -> more stimulus -> inflating asset prices -> continued demand for treasuries -> increasing debt…

And the likely impact on stock prices for the next 5 - 10 years, maybe the Robinhood crowd isn’t completely crazy to look through the obvious near-term uncertainty.

Asian Tech Implications: Private Pops…

Because of the above, we have reached an interesting dichotomy between the public and private markets, in the near term at least, with implications on Emerging Market tech champions at an important inflection point in network-effect driven industries.

Institutional Limited Partners tend to favor stability, longevity and the long-term. They act as stewards - and the responsible path forward for stewards in the event of the VIX hitting 82, rolling global lockdowns and record unemployment is to “wait and see”. This “wait and see” tends to have a cascading effect through the private markets. LPs are slower to close new funds with GPs. GPs, having a progressively harder time raising the next fund, slow their pace of deployment. Startups and growth companies who were previously being chased by Investors, are now doing the chasing. With the IPO window closed and “path to profitability” as the new mantra, cuts, bridge rounds and down rounds become the norm.

…But Public Keeps Dancing

On the other side of the aisle, the music is still on. Thanks to the effective equities backstop by the Fed and other central banks, combined with the COVID defensibility of most large tech stocks, as well as the growth premium in a deflationary market environment, the COVID era is potentially the best time ever to be a large tech company. And the market agrees:

As of April 23, 2020, the market caps of MSFT, GOOG, FB, AMZN, and AAPL, accounted for >20% of the S&P 500.

But this is not just a U.S. phenomenon. With surging share prices around the globe, large, public tech firms are enjoying a subsidy in terms of cost of capital relative to both other sectors and potential competitors in the private markets.

As I covered last week, there are many underlying trends favoring consolidation in Asian tech ecosystems, but let’s add yet another to the list. The current monetary regime is a subsidy to public tech incumbents as they pour resources into aggressive “customer amortization” across new business lines. Fuel to the super app fire.

Not only do current monetary practices exacerbate economic inequality across individuals, it does the same thing in business. Without policy intervention, the gap between the haves and the have-nots will only grow.