Mapping the Crypto Cycle

Calling bottoms is impossible, but long-term investors are taking note

Disclaimer: this is not investment advice. Do your own research. Crypto is risky, and bear market rallies are very common

Mapping Crypto Cycles

Crypto is a highly cyclical, reflexive asset class. Historically, investing after large pullbacks have performed very well.

With global debt / GDP at ~400% globally, a recession imminent, continued monetary debasement a foregone conclusion, increasing weaponization of the existing financial system, and decreasing confidence in existing institutions… the secular tailwinds behind this adoption story seem unlikely to stop.

Many people ascribe this cyclicality to the “Bitcoin Halving” when new supply issuance from Bitcoin drops every 4 years. Historically, this marks the shift from the “recovery phase” to the “bull market phase”.

As Raoul Paul at GMI has pointed out, this cyclicality is also highly correlated to monetary debasement. The Bitcoin “halving thesis” may be a red herring for what is really “money printer go brrr”.

Source: Real Vision Reports

I have also previously outlined the nuance between inflation vs. debasement’s differing impact on crypto prices back in May for those who want to take a deeper dive.

The long-story short is growth metrics are plummeting, the yield curve has inverted, DXY YoY is at a six-year high, and it seems likely the Fed will have to intervene once more to stop the coming deflationary spiral.

This leading ISM survey forecasting a dramatic decline….

Source: Real Vision Reports

Despite this pending carnage, the crypto adoption story remains strong - continuing its vacuuming of the ~5b global internet base. Both ETH and BTC have been ~2 standard deviations oversold relative to logarithmic adoption.

The market is clearly focused on the the short-term Fed resolve, but zooming out provides longer-term investors with more comfort.

And as we know, crypto’s adoption story is much greater than Bitcoin. I personally find Multicoin’s three “Crypto Mega Theses” outlined below to be the most compelling…

The “settlement layer” for the internet is a particularly interesting battle ground. Programmable money, smart contracts, essentially vying to become the “operating system” of the decentralized web.

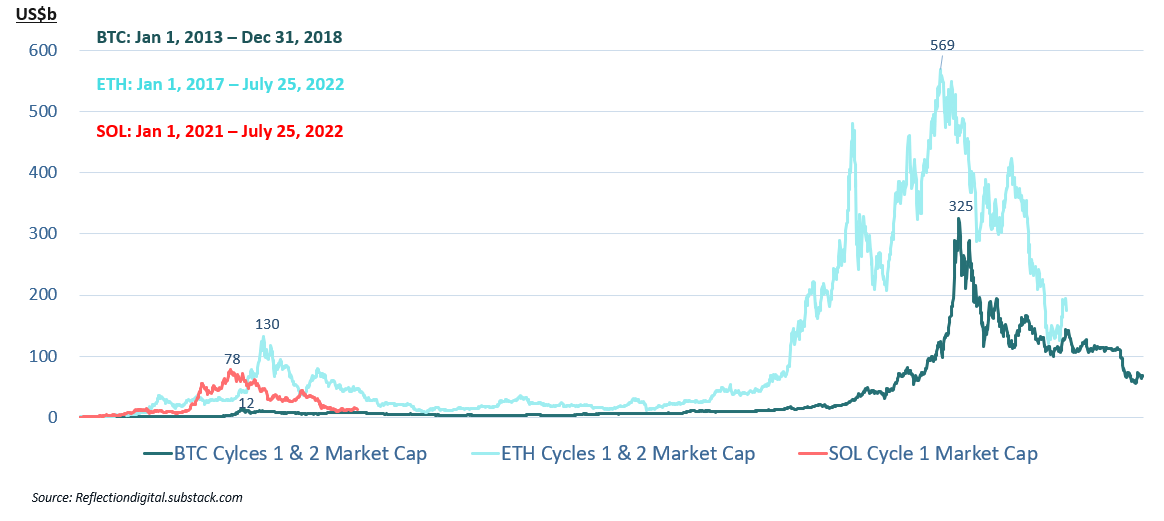

As we have seen from ETH and SOL, their first two cycles dramatically outstrip that of Bitcoin likely leading to a “flippening” in the coming cycle - as the total addressable market for Ethereum, Solana, and other “Layer 1’s” likely proves bigger than “digital gold”.

Beyond layer 1s, the real money in each crypto cycle is made by early adopters of the “rising narratives”. Crypto is cyclical and reflexive and tends to overhype projects in the short term during each “mania phase”. We discuss this dynamic in “The Fourth Wave” - outlining which “narratives” we suspect will receive euphoria sentiment in the coming cycle….

This familiar dynamic played out again in 2021… leading to spectacular returns for early adopters (as outlined below…), and spectacular declines as the euphoria melted away in the phase of limited traction and an increasingly aggressive Fed.

However, even in a tough macro environment, there are sandboxes to dive into for the rare crypto “value investor” out there searching for compelling fundamentals amidst the sell off… particularly in DeFi and NFT marketplaces.

(Please note: prices are from last week and have moved significantly. Also, please be aware of “earnings contraction” from protocols in the bear market… most figures presented on annual protocol revenues, many of which are now in decline given market sentiment…)

In Conclusion…

The bottom is impossible to call. However, generally ~70%+ drawdowns in major crypto assets have led to strong returns for long-term holders who can stomach the interim volatility.

Many assets from 2021 will go to zero, but a few will outperform Bitcoin in the coming cycle and lead to large returns to early adopters of this nascent but expanding asset class.

Our job is to try and find out which :).

Happy hunting