iFlix's Original Sin

A Regional Aggregator in a Global Sandox

Relatively short one this week given the existing coverage, but Tencent’s purchase of iFlix is an instructive case study on which pockets emerging tech champions are likely to have success.

Streaming is not one.

From Bloomberg:

“Chinese internet giant Tencent Holdings Ltd. is buying certain assets of iFlix Ltd., a struggling streaming platform with about 25 million users focused in South and Southeast Asia.

Tencent will acquire iFlix’s content, technology and resources, expanding its geographic reach in a key area of growth. The Chinese company will not take on iFlix’s debt, according to people familiar with the matter…

‘This is in line with our strategy to expand our international streaming platform, WeTV, across Southeast Asia and provide users with international, local and original high-quality content in a wide range of genres and languages’, Tencent said in an emailed statement”

I’m not surprised by Tencent’s ability to buy cheap. This is a fairly straight forward application of the geographic levels of aggregation. iFlix was trying to be a regional aggregator on a global stage.

As I wrote on June 4th regarding the economics of aggregation:

“The interesting thing is that the level of aggregation matters and is different for different business models with different outcomes for the participants. Aggregators can be local, national or regional, or even global depending on the friction involved - the relevant physical barriers, different regulatory jurisdictions etc - in order to transact.

Purely digital aggregators like social networks or streaming services are not bound by physical barriers and have been increasingly able to implement global networks resulting in massive businesses - like Facebook or LinkedIn or Netflix.”

Founded in 2014, iFlix was aiming to be the “Netflix for emerging markets” with local content and lower cost, ad-driven monetization. Clearly a high growth category with a large & underpenetrated market opportunity with a serial founder leading an experienced team from all the right logos.

With 25 million users in just ~5 years, iFlix clearly had traction and a valuable user proposition.

What went wrong?

In the “X for Y” Pitch, Be Sure to Avoid the X

The core problem in trying to build the “Netflix for emerging markets” is well… Netflix. In a world of zero marginal costs where content is delivered over the internet, there is nothing stopping Netflix from competing directly with iFlix for customers - and with much deeper pockets & a broader library at its disposal.

“But Pondering” you interject, “look at the outcome of the original Uber vs. Grab war. David vs. Goliath. The local start-up fending off the deep-pocketed foreign champion through intense market focus and localization.”

To which I reply - look at Facebook, look at LinkedIn, look at Whatsapp, look at Google, look at TikTok. Look at the level of aggregation & friction to serve dispersed customers. Netflix is closer to Facebook than to Uber. While Uber has built a massive business, the economics will always be inferior.

Later in the same June 4th post:

“Other aggregators are more hyper-local in nature. They tend to be the most levered to offline SMEs - platforms like Grab, Gojek, Meituan-Dianping, DoorDash etc - that offer on-demand services in ride-hailing, food delivery, or affiliate marketing to local establishments.

The networks in this last category are inherently more constrained as they depend on local liquidity as opposed to regional level liquidity. If I want a ride on-demand, I will generally only be interested if the wait time is under 7 minutes etc…

Hyper-local platforms levered to offline tend to have poorer economics because the cost to service the next marginal customer is not zero (unlike say Facebook), but also because the lack of broader network effects or aggregation-level limits the barriers to entry and invites competition”

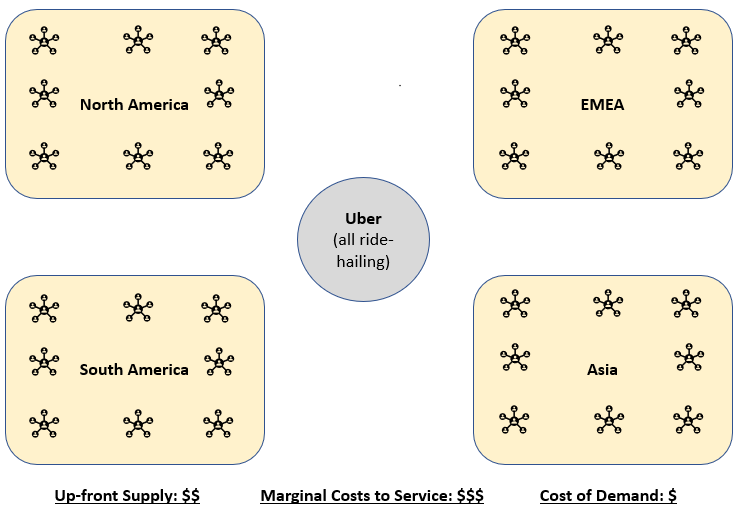

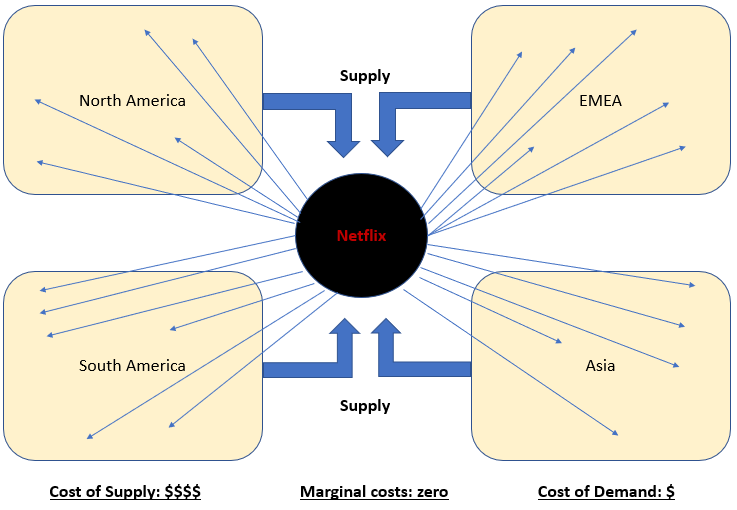

Looking at the rough network depictions & relevant costs below, the differences become clear.

Uber’s Network:

vs Facebook’s Network

vs. Netflix’s Network

Netflix is a bit in between. The cost of servicing an additional customer is essentially zero and scales globally. Streaming, though, is not like social media - where virality and user-generated content combine to mean relatively little costs on both the supply and the demand side as it grows.

Streaming has very real costs.

Content is King & the King Isn’t Cheap

Netflix still pays to generate demand (US$2.7b in 2019 marketing costs to be exact), but the real costs are on the supply side. Netflix COGs in 2019 was US$12.4b - primarily from the amortization of “content assets”; the engine that powers its ~183m paid members driving US$20b+ in revenues - growing ~27% YoY.

Netflix learned early-on streaming is a content & scale game. The only problem is you need the content before you can acquire customers, and content is expensive. Content is king. Capital is crucial for content. Market leadership crucial for cheap capital. And capital poured into up-front content acquisition over the last 20 years are assets that can be amortized over a global customer base.

Are there local tastes? Of course.

Is every film applicable to every audience? No.

Is a portion of the US$12.4b Netflix spent last year & the virtual library built over the prior 20 years with >1000 originals relevant to global audiences? Yes (and even more so with continued investments in dubbing & original local content).

Are there barriers to entry in certain markets that will hold up penetration - i.e. payments infra, internet connectivity, content regulation etc? Yes.

Are those especially profitable customers right now anyway? No.

Is servicing those customers today a tax on capital that could be better spent on incremental content which will be available to those customers when they become more attractive in time? Most likely.

When the time comes, will emerging customers choose a local player or gravitate towards a global champion who will have potentially spent US$100b in aggregate on content by that time? I imagine the latter.

Netflix is an all you can eat buffet. And unless there are specific zoning regulations (China), the buffet is delivered to everyone’s living room. There is little need for a second all you can eat buffet in the same house.

iFlix was started in 2014, a full seven years & ~US$25b in market capitalization after Netflix started streaming. Those are pretty long odds in a market with zero-marginal-costs and limited regulatory barriers to entry.

The recent Hooq liquidation is instructive. Despite 80m users and strong backers / partners like Singtel, Warner Bros and Sony Pictures, Hooq’s press release lays it out bluntly:

“Global and local content providers are increasingly going direct, the cost of content remains high, and emerging-market consumers’ willingness to pay has increased only gradually amid an increasing array of choices. Because of these changes, a viable business model for an independent, OTT distribution platform has become increasingly challenged.”

The same write up could have been for iFlix or Viu or even GoPlay a few years down the line. Netflix is now at a US$195b market cap, US$20b+ in revenues growing ~27% YoY with no plans to spend less than ~65% of that on just one thing: fortifying its content library. A library available to (almost) anyone with an internet connection.

Hundreds of millions will not cut it. To play in streaming, you need deep pockets.

Streaming - A Preview to the Digital Decoupling

Streaming (long-form) was never likely to have a Southeast Asian champion. Like other digital fields, the economics don’t make sense. In a winner-take-all market, market shares tend to… well, consolidate. Outside of significant regulatory barriers for entertainment, which most countries do not have, I would have been quick to write-off challengers as inevitable casualties to Netflix’s international push.

Then Tencent acquired iFlix.

That caused me to pause. In the new geopolitical environment, I’m now wondering if streaming is a preview to consumer internet aggregators in a decoupling world. Chinese internet giants no longer relying on a regulatory moat, but leveraging profits from core businesses in their massive home market to pull other geographies into its aggregation sphere in digital, winner-take-most realms like streaming.

One aggregator for China and its sphere of influence. One aggregator for the West and its sphere. The iFlix purchase is clearly a move to add Southeast Asia streaming into the Chinese sphere, and Tencent is one of the few players large enough to go toe-to-toe with Netflix in content spend.

The iFlix announcement makes more sense when viewed in the wake of rumors emerging earlier this month that Tencent is in talks to purchase a large stake in iQIYI from Baidu. For the unfamiliar, iQIYI is the “Netflix of China” and neck and neck competitor to Tencent’s online video business.

The two businesses are clearly #1 and #2, well ahead of Alibaba’s Youku as a distant third (MAUs in millions):

As well as paid subscribers, each with > 100m

The tie up is speculative, but as Baidu owns ~57%, there is a chance Tencent comes away as the controlling shareholder. The industrial logic makes obvious sense as competition for content and negotiating leverage would be substantially enhanced, crowning Tencent the dominant market leader in online video in addition to the same title it holds for gaming.

iQIYI has >500m MAUs with users spending ~69 min per day, 119m of which are paying users - though at an average sub price point of just ~12 RMB (<$2 USD) generated US$1.1b in revenues in Q1 - equal to its content spend.

Assuming annual run-rate (x4) of ~US$4.4b and Tencent Video (with essentially the same MAUs and paying subs) is roughly the same size, the combined entity is spending ~US$8 - 9bn on content annually, making it one of the few players on earth capable of bidding vs. Netflix globally.

That is why I think the iFlix acquisition makes sense. Tencent is one of the only players capable of going head to head with Netflix outside of China. Buying up the iFlix library of local Southeast Asian hits & Korean dramas for pennies on the dollar (“tens of millions” compared to hundreds of millions raised) is a relatively small price to pay for the coming war with Netflix; a smart bet that while local content isn’t enough on its own, it’s an important supplement for whether Southeast Asians will be pulled into the Eastern or Western spheres of entertainment influence.

It’s highly doubtful consumers will pay two monthly subscriptions. Many in Emerging Asia are still reluctant to pay one.

While Netflix is the global front runner, I think letting iFlix go to Tencent was a mistake which may come back to bite Netflix. As Tencent shores up its position at home, prices for premium content will come down even as its willingness to pay goes up as it can amortize the cost of the content over more consumers. Adding Southeast Asia to its sphere of influence will only make the content investments that much more attractive.

Amidst a polarizing geopolitical backdrop, the stage is now set for Chinese Aggregators and U.S. Aggregators to compete in unbiased international waters each staking out a perimeter. A game that will be determined by capital and content.

The game is just starting, and we are already seeing Southeast Asian consumers pulled in different directions.