Anarcho-Capitalism vs. Democracy On-Chain

Ethereum, Cosmos, the Monoliths and the design tradeoffs at crypto's core

This week, we explore tradeoffs at the base-layer. In particular, how differences in Ethereum’s and Cosmos’ progression will impact a similar end vision.

Topics include:

The end of easy money and the implosion of Layer 1 summer

Modular vs. Monolithic vs. App-specific Layer 1 designs

Building consensus around “modularity” and competing paths to maximize security and customization

Where the internet of information differs from the internet of value

Investment considerations for different time horizons…

Apologies for the hiatus. The last two months have been wild, but now is the time to start zeroing back in. May be a bit spotty heading into the holidays, but hope to up newsletter output into 2023 :)

Disclaimer: This is not investment advice. Crypto is risky. Please do your own research.

The Red Wedding

The dust from the 2021 Layer 1 wars is beginning to settle. The path to the citadel is littered with maimed or dead bodies. The easy-money euphoria cut short; Jerome Powell hijacking the punchbowl deep into the evening leaving a Red Wedding on trading screens in his wake.

(-100%) Terra Luna

(-92%) Solana

(-88%) Avalanche

(-82%) Polkadot

(-77%) Cardano

(-73%) Cosmos

(-65%) Ethereum1

Macro indeed won; the once two trillion dollar asset class thrown around like a rubber ducky in a hurricane. Crypto found itself alongside high-growth, non-profitable tech as fund managers and retail alike fled to the only reliable safe-haven around: the US dollar. The near-one correlation only deviating for short, idiosyncratic deleveraging cascades brought on by Luna’s collapse, 3AC’s demise and more recently, the largest fraud since Enron. Industry titans are on the brink. Crypto lenders are either insolvent or are nervously sitting by their phones. Funds are in liquidation or are “managing” LPs. Volumes are beginning their slow slide towards the X axis. The dark clouds of a 2023 recession loom ahead.

Winter is here.

Obvious parallels with the dot.com crash jump to the forefront. Transformative potential is on the horizon, but the prophesied “killer apps” remain elusive, onboarding friction devilish, and penetration curves notably stalled. Still, for those with conviction, the next six months will likely present strong entry points. The key question becomes: how do I parse out the Amazon from the Pets.com? The Myspace from the Facebook? The Google from the AltaVista?

A thoughtful review of design choices today could be the difference between early retirement and finding yourself among the next cycle’s #Lunatics.

Arguably no question is more important than which ecosystem to build or invest in.

Monolithic, Modular, or Make Your Own Adventure…

2021 was the year of base-layer experimentation. Ever faster, cheaper transactions combined with easy money and speculative euphoria lured retail to the latest hot chain, trumpeting colorful buzzwords like “Subnets”, “EVM-compatibility”. “Parallel Execution Engine”. “Directed Acrylic Graph” and more. The promises of a financial infrastructure overhaul, near-infinite market size, zero rates, and helicopter money to boot, nurtured Layer 1 summer to a feverish pitch.

As the hangover sets in, sober minds are re-examining the trade-offs at the heart of crypto’s base layer. Looking 3, 5, 10 years ahead, which design is likely to attract the developer talent, usage, performance, and security necessary to become the “settlement layer for the internet”?

The current design continuum sits below:

Monolithic

Monolithic chains - like Solana, Aptos, and Sui - target fast performance today on a single, all-purpose chain where dApps (decentralized applications) share the same consensus mechanism, data availability layer and execution environment. This provides frictionless composability and has produced several chains with impressive transaction throughput. However, bouts of congestion and limited customizability provide ammo to skeptics claiming a monolithic approach will never scale to billions of users across diverse use-cases. As Layer 1 summer dies down, momentum is shifting towards the other end of the spectrum.

Monolithic torch-bearers: Solana, Aptos, Sui, Ethereum (base layer)

App-Chains

In the red corner we have the “app-chain” evangelists, favoring a more open-ended “ecosystem of interoperable blockchains”. This approach is most associated with Cosmos - providing developers with customizable templates for easily launching new blockchains around specific applications.

Cosmos’ vision is a bottoms up approach, an organic “mesh” of overlapping, sovereign networks; a network of networks similar to the internet fostering a web of chains as diverse as the communities which spin them up.

Each chain can tweak the basic parameters to best meet a desired use-case and reduce the “rent” paid to an underlying base layer. The benefits of enhanced customization and value capture are balanced by the downsides of more limited security guarantees and higher friction in composability. To solve this, Atom 2.0 is pushing the ecosystem towards “inter-chain security” - allowing different chains to form alliances of shared security to further integration after its successful implementation of inter-blockchain communication (IBC) transfers last year. In doing so, the ecosystem hopes stand-alone communities can band together to share security much like the NATO-military alliance while maintaining individual sovereignty.

App-Chain torch-bearer: Cosmos

The below summary from Delphi Digital’s “Finding a home for Labs” succinctly outlines the tradeoffs between the monoliths and the app-chain world as they evaluate where to build after the Luna collapse.

Modular / Fractal

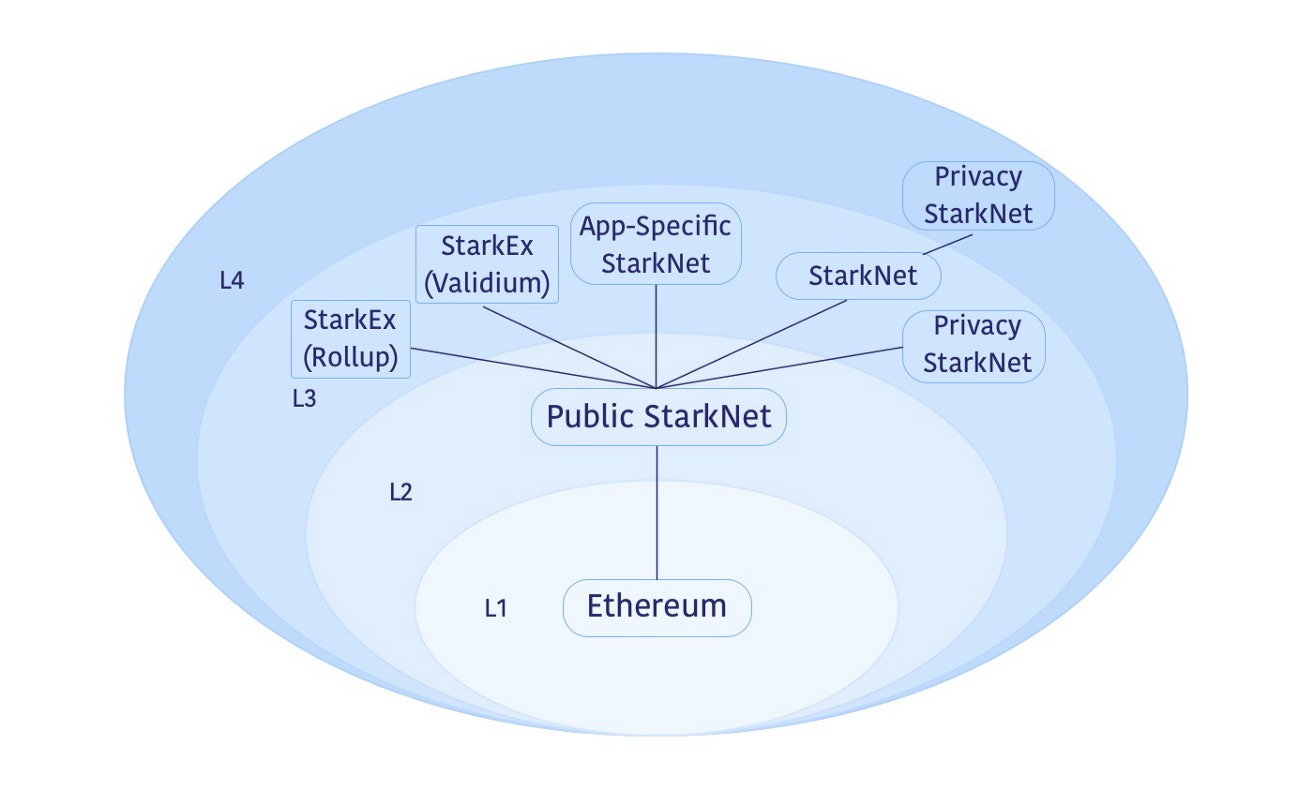

Between the two bookends, the Ethereum ecosystem has a promising, yet extended roadmap to have its cake and eat it too. Leveraging advances in zero-knowledge tech, Ethereum aims to marry the scalability / composability of the monoliths with the customizability / flexibility of the app-chain approach. This vision prioritizes base-layer security and decentralization, while scaling up using a fractal approach of rollups and other zk-tech which allow for greater transaction throughput and customization in the higher layers (Layer 2 and 3) of the chain, while settling back to and inheriting the security of the Ethereum base layer.

Source: Starkware - Fractal Scaling

In many ways, the end vision of both Cosmos and Ethereum is the same: use-case customization, trustless interoperability, high-performance and strong security guarantees for the apps built atop the decentralized infrastructure.

However, the sequence of actions is inverted: Cosmos starts with customizability and aims to bootstrap ever-greater security as activity / value increases on the network while Ethereum prioritizes security and adds incremental layers for flexibility / performance over time.

This difference in roadmap sequencing will likely determine which side of the market cap power law ATOM and ETH end up, respectively.

ETHEREUM VS. COSMOS: sequencing matters

Over the last six months, the monolithic thesis has come under fire - partially because of its association with a certain EA-shilling, meat-eating, vegan polycule in the Bahamas - but also due to justified concerns regarding the inflexibility in dealing with diverse use cases from DeFi, to gaming, to supply chains, to NFTs.

Thus, the app-chain thesis has been on the ascendance. A belief that apps themselves, with control over the user relationship, will ultimately tire of leaking “rents” to an underlying chain which forces frustrating compromises in meeting the needs of specific use-cases. Once an application - say DYDX - reaches a large enough size, they will choose to migrate to their own chain.

To summarize:

On the one hand, we have the true “internet of blockchains”. To let 100 flowers bloom in a chaotic intertwined mesh. A bottoms up, organic petri-dish of libertarian activity

or

On the other, an initial emphasis on a strong spine of security and decentralization at the base layer on which to build a fractal structure of layers which provide greater throughput, less costs, and further customization in time, without sacrificing on security.

While the internet took the former path, I’m inclined to believe the internet of value may follow a more structured course. A blockchain’s most notable attribute is the facilitation of trust - or, more accurately, its removal. Without a strong foundation, all the vibrancy and richness of the accompanying app layer becomes fragile. By prioritizing security and decentralization out of the gate, Ethereum focuses on what makes blockchain truly unique and attracts developers who target use cases - like money, finance and identity - which are likely to accrue the most value.

Let’s take a look at an (admittedly stretched) metaphor.

Anarcho-Capitalism vs. Constitutional Democracy

As opposed to information networks, blockchains are more like nation-states. They aim to secure trillions of dollars in property on behalf of users and need to align on foundational principles on which these digital communities are organized.

Cosmos aims to provide maximum sovereignty to its communities; a more free-wheeling, experimental mesh of sovereign networks which can customize their own legal systems and parameters but are able to band together in community-funded alliances for security against outside threats. In many ways, the level of experimentation and community autonomy is commendable:

“Why not let each community decide what is important to it and prioritize accordingly?”

“Why not provide complete flexibility and discover which parameters work best?”

“Why should we not take the internet of information approach to the internet of value?”

By providing flexibility, the Cosmos ecosystem is betting it can attract developers across a wide range of use cases constructing vibrant ecosystems of economic activity which can be used to fund military alliances with enough security for sustained growth. It’s kind of like the autonomous Greek city who can combine forces when necessary to fight a shared Persian invasion.

Ethereum, on the other hand, provides more structure; more like a constitutional democracy. A single meta-community (with many diverse communities within it) sharing certain ground rules / constraints (a constitution if you will) which constituents believe best promotes a pluralistic, vibrant digital society. The agreed upon ground rules include “taxes” (gas fees) and a partition of powers (decentralization) which helps to fund defense (PoS security) protecting the nation’s legal system (smart contracts) necessary to facilitate commerce (exchange), property rights (encryption), identity (SBTs), and other institutions we associate with human flourishing under more liberal (small L) regimes.

While innovative, the Cosmos approach is almost TOO neo-liberal or even anarcho-capitalist with a problematic degree of flexibility and lack of structure to build a shared digital community. Hobbes pre-Leviathan; idealistically hoping for Rousseau’s “noble savages” to live in harmony without the monopolistic force which establishes the order necessary for human flourishing. Whether men with guns or state-level censorship resistance, a monopolistic defense of property rights and the rule of law is essential for thriving economic activity.

The lack of structure and shared defense at the start will cause developers and users in high value use cases to question settling in the Cosmos ecosystem, making it difficult to achieve the monetary premium necessary to defend the “sovereignty” Cosmos communities so value.

Steve Newcomb, CPO of Matter Labs’ ZK-sync draws an apt metaphor when he praises Cosmos for its vision and innovation, but believes the ecosystem will become web3’s “Myspace”; too chaotic to build a sustained billion+ person network.

I tend to agree. Time will tell.

Investment Considerations - for the fox & the hedgehog

The above, however, says nothing about whether ETH or ATOM (the ecosystem’s respective “reserve currency asset”) presents a better investment opportunity as of Dec 2022.

While I may find Ethereum’s sequencing more favorable towards attracting higher-value use-cases for which I find public blockchains most relevant and the project with the most compelling roadmap in marrying the security and flexibility essential for long-term success, the market clearly agrees.

Ethereum is valued at ~US$160b vs. ATOM at a mere ~US$2.75b. Am I ~58x as sure Ethereum will command the same dominant position in 5 to 10 years? No.

ETH has clear advantages - network effects in terms of developers, security, and liquidity, not to mention the most comprehensive roadmap for scaling sustainably. However, the below transition from base-layer Ethereum to a ZK-enabled fractal utopia will not happen overnight.

While Ethereum has the highest probability in becoming the settlement layer for the internet, it will not have 100% share. As inflation is beginning to roll over and (hopefully) liquidation cascades begin to slow, riskier assets may once again catch a bid in the back half of 2023 as the tightening of financial conditions subsides.

Ethereum’s constitutional democracy is slow and steady - providing fertile soil for long-term builders. However, it also suffers from the law of large numbers and less short-term dynamism. Cosmos, on the other hand, is well-positioned to attract less patient builders from other maimed Layer 1 ecosystems while Ethereum works methodically through its extended roadmap.

For multi-decade hodlers, ETH is still the unrivaled smart contract platform to own. For more aggressive traders looking to catch a bounce in the Layer 1 echo bubble, ATOM is a leading contender to climb the Layer 1 leader board despite leaky short-term tokenomics.

As is often the case, an investment thesis can be quite different across time horizons. It’s always good to know if you are a Fox or a Hedgehog. When in doubt, its usually safest to stick with the latter.

****

YTD figures as of Dec 13 2022